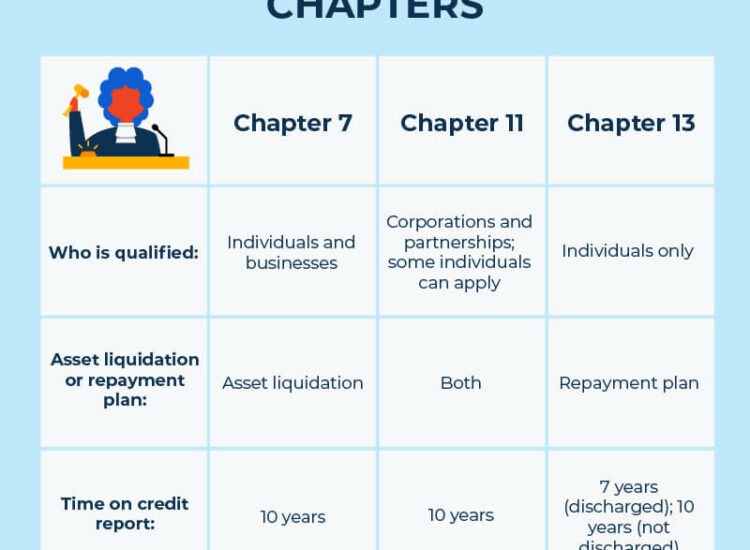

For businesses facing overwhelming financial challenges, where debt burdens make continued operation seemingly impossible, but the underlying business model holds promise, a pathway to survival and restructuring exists within the Bankruptcy Code. While individuals often utilize Chapter 7 for liquidation or Chapter 13 for a wage earner’s plan, businesses (and some high-net-worth individuals with complex finances) frequently turn to Chapter 11 bankruptcy. Chapter 11 bankruptcy is a powerful and intricate legal process designed for reorganization, allowing a distressed entity to restructure its debts, operations, and financial obligations under the supervision of the bankruptcy court. It provides a legal framework for businesses facing insolvency to continue operating, preserve assets, negotiate with creditors, and develop a viable plan to emerge from bankruptcy as a healthier, more sustainable entity. Understanding what is Chapter 11 Bankruptcies is crucial for business owners and stakeholders grappling with severe financial distress and seeking a mechanism to rescue a potentially viable enterprise from collapse. It is a distinct and often complex form of bankruptcy case within the broader system of Bankruptcy Law, aimed at providing a second chance through restructuring rather than outright liquidation. This comprehensive guide will delve into the core concepts of Chapter 11 bankruptcy, explaining its purpose, outlining who typically utilizes it, detailing the multi-phase Chapter 11 process from initial filing to plan confirmation, and discussing the significant Chapter 11 benefits and Chapter 11 challenges associated with this specific type of bankruptcy. For those questioning what is Chapter 11 Bankruptcies and whether it might be a solution for a struggling business, this guide provides essential clarity.

Toc

Defining What is Chapter 11 Bankruptcies: The Path to Reorganization

At its essence, Chapter 11 bankruptcy provides a lifeline for businesses that are financially distressed but possess a viable core operation worth saving. It is a sophisticated legal tool under the Bankruptcy Code that prioritizes reorganization over immediate liquidation, setting it apart from other common types of bankruptcy. Understanding what is Chapter 11 Bankruptcies requires recognizing its purpose as a mechanism for restructuring debt and operations.

The Core Concept: Chapter 11 Bankruptcy Explained as a Business Reorganization Tool

Chapter 11 bankruptcy, as defined by the Bankruptcy Code, is a chapter within Bankruptcy Law that provides a legal framework for businesses (and occasionally individuals with very large and complex debts) to reorganize their financial affairs while continuing to operate. The fundamental concept is to allow the debtor to propose a plan to restructure its debts, contracts, and operations to return to profitability and repay creditors over time. Unlike Chapter 7 bankruptcy, which involves the liquidation of assets, Chapter 11 bankruptcy focuses on rehabilitation and continuity.

In most Chapter 11 bankruptcy cases, the debtor remains in control of its business operations as a “debtor in possession.” The debtor in possession has most of the powers and duties of a bankruptcy trustee but operates the business under the supervision of the bankruptcy court. This allows the business to continue serving customers, employing staff, and generating revenue while simultaneously working through the legal process of restructuring its debts. Chapter 11 bankruptcy is used to renegotiate terms with secured creditors, address burdensome contracts or leases through assumption or rejection, sell off non-essential assets, and ultimately propose a Chapter 11 Plan of Reorganization that outlines how the business will operate going forward and how creditors will be paid. This focus on continuing operations and restructuring makes Chapter 11 bankruptcy a powerful tool for businesses facing insolvency but with a strong underlying potential for future viability. When people refer to what is Chapter 11 Bankruptcies, they are typically talking about this complex process of using Bankruptcy Law to reorganize a struggling enterprise.

The Primary Goal: Achieving a Viable Future Through a Chapter 11 Plan of Reorganization

The ultimate objective and defining feature of Chapter 11 bankruptcy is the successful development, negotiation, and confirmation of a Chapter 11 Plan of Reorganization. This plan is the centerpiece of the case and outlines the roadmap for the debtor’s emergence from bankruptcy as a financially stable entity.

The Chapter 11 Plan of Reorganization details several crucial aspects of the reorganized business:

- Classification of Claims: It groups creditors into different classes (e.g., secured creditors, unsecured creditors, priority creditors).

- Treatment of Claims: It specifies how each class of creditors will be treated, outlining the amount and method of payment they will receive over time, or other forms of compensation (like equity in the reorganized company).

- Future Operations: It describes how the business will operate after emerging from bankruptcy, often including strategies for improving profitability, selling assets, or changing management.

- Funding the Plan: It explains how the reorganized business will generate the necessary funds to make the payments proposed in the plan.

Developing a confirmable Chapter 11 Plan of Reorganization is a complex process that involves extensive analysis, negotiation with creditors and other stakeholders, and compliance with the strict requirements of the Bankruptcy Code. The plan must be approved by a vote of the creditors in each class (except in rare “cramdown” scenarios) and ultimately confirmed by the bankruptcy court. Successfully confirming and implementing the Chapter 11 Plan of Reorganization is what allows the debtor to achieve discharge of debt for qualifying restructured debts and continue operating, representing the core Chapter 11 benefits and the pathway to a viable future after navigating Chapter 11 bankruptcy. Understanding what is Chapter 11 Bankruptcies is deeply intertwined with the concept and successful implementation of this reorganization plan.

Who Typically Files: Businesses and Individuals Utilizing Chapter 11 for Complex Debt Issues

While Chapter 11 bankruptcy is primarily associated with corporate restructuring, it is available to various types of debtors who face complex financial situations that require a more flexible and comprehensive approach than offered by Chapters 7 or 13.

The most common filers under Chapter 11 bankruptcy are businesses of various sizes. This can range from small, privately held companies to large, publicly traded corporations. Business bankruptcy Chapter 11 is utilized when a company faces significant debt burdens, operational challenges, or legal liabilities that threaten its existence, but where the business still has a valuable underlying operation that could be profitable if restructured. It provides the business with the tools to negotiate with creditors, reject burdensome contracts, and continue operating under court supervision while working towards a reorganization plan.

Less frequently, Chapter 11 bankruptcy is also utilized by individuals. This is typically limited to high-net-worth individuals who have very large and complex debts that exceed the debt limits for eligibility under Chapter 13 bankruptcy. These individuals may own multiple properties, have business interests, or face significant liabilities from complex financial transactions that require the flexibility and restructuring capabilities offered by Chapter 11. However, the vast majority of individual bankruptcy cases fall under Chapters 7 or 13, making Chapter 11 bankruptcy primarily a tool for business bankruptcy Chapter 11. Understanding what is Chapter 11 Bankruptcies includes recognizing that it is a solution for complex financial situations requiring a tailored restructuring approach.

1. https://tamtho.com.vn/mmoga-exploring-aws-cloud-computing-the-worlds-leading-cloud-platform/

4. https://tamtho.com.vn/mmoga-understanding-the-landscape-what-are-the-3-types-of-bankruptcies/

5. https://tamtho.com.vn/mmoga-facing-overwhelming-debt-why-you-need-a-lawyer-for-bankruptcies/

The Chapter 11 process is significantly more involved, lengthy, and costly than consumer bankruptcy cases under Chapters 7 or 13. It is a multi-phase legal proceeding requiring expertise and careful adherence to the Bankruptcy Code and court procedures. Successfully navigating the Chapter 11 process is key to achieving a confirmed reorganization plan.

The Initial Steps: Filing Chapter 11 and Becoming the Debtor in Possession

The Chapter 11 process officially begins with the debtor filing Chapter 11 bankruptcy petition and a set of initial documents with the federal bankruptcy court. This filing immediately triggers the automatic stay, which halts most collection actions against the debtor, providing critical breathing room.

Upon filing Chapter 11, the debtor typically becomes the “debtor in possession.” This means the business entity continues to operate its day-to-day affairs, make business decisions, and control its assets under the court’s oversight, without a trustee being initially appointed (unless there is evidence of fraud, dishonesty, or gross mismanagement). The debtor in possession has a fiduciary duty to manage the business and its assets for the benefit of creditors. This is a core feature distinguishing Chapter 11 bankruptcy from Chapter 7, where a trustee takes control of assets.

The initial steps in the Chapter 11 process also involve filing various documents shortly after the petition, including schedules of assets and liabilities, statements of financial affairs, and lists of creditors. The debtor must also fulfill certain ongoing reporting requirements to the court and the U.S. Trustee (a division of the Department of Justice that oversees bankruptcy cases) while operating as a debtor in possession. These initial steps lay the groundwork for the restructuring efforts to come in Chapter 11 bankruptcy.

Key Players: The Role of Creditors and the Bankruptcy Court in Chapter 11

Unlike simpler bankruptcy cases, Chapter 11 bankruptcy involves several key players whose participation and negotiation are crucial to the process, particularly the creditors and the bankruptcy court.

Creditors play a significant role in the Chapter 11 process. Creditors are typically grouped into different classes based on the nature of their claims (e.g., secured creditors, unsecured creditors, priority creditors). In larger cases, committees of creditors (most commonly an unsecured creditors’ committee) are formed to represent the interests of their respective classes and negotiate with the debtor regarding the terms of the Chapter 11 Plan of Reorganization. These committees have significant influence in the process and can object to proposed plans if they feel their interests are not adequately protected. The debtor must solicit votes from creditors on the proposed plan, and acceptance by a majority of creditors in each class (in number and amount of debt) is required for confirmation.

The bankruptcy court plays an active supervisory role throughout the entire Chapter 11 process. The judge presides over hearings, rules on motions filed by the debtor, creditors, or the U.S. Trustee, resolves disputes, and ultimately makes the final decision on confirming the Chapter 11 Plan of Reorganization. The court ensures that the process adheres to the rules of the Bankruptcy Code and that the proposed plan is fair and feasible. The interaction and negotiation between the debtor, creditor committees, and other stakeholders, all under the oversight of the bankruptcy court, are central to the complex dynamics of Chapter 11 bankruptcy.

Developing and Confirming the Chapter 11 Plan of Reorganization

The most critical and often most challenging phase of the Chapter 11 process is the development, solicitation, and confirmation of the Chapter 11 Plan of Reorganization.

The debtor has an initial exclusive period (typically 120 days, extendable by the court) during which only the debtor can file a plan of reorganization. If the debtor files a plan within this period, they also have an exclusive period (typically 180 days from the filing date, extendable) to solicit acceptances of the plan from creditors. If the debtor fails to file a plan or get it accepted within these exclusive periods, other parties (like creditors or the trustee if one is appointed) can file their own plans.

Developing the Chapter 11 Plan of Reorganization is a complex undertaking that requires detailed financial analysis, valuation of assets, negotiation with various creditor classes, and adherence to the disclosure requirements of the Bankruptcy Code. The plan must be accompanied by a disclosure statement, which provides creditors with sufficient information to make an informed decision about voting on the plan. After the plan and disclosure statement are filed and the disclosure statement is approved by the court, the debtor solicits votes from creditors.

If the plan receives the necessary votes from creditors, the debtor asks the bankruptcy court to confirm the plan. The court holds a confirmation hearing to determine if the plan meets all the legal requirements for confirmation under the Bankruptcy Code, including feasibility, fairness, and good faith. If the court confirms the plan, it becomes legally binding on the debtor and all creditors. Successfully confirming the Chapter 11 Plan of Reorganization is the culmination of the Chapter 11 process and the gateway to the debtor’s emergence from Chapter 11 bankruptcy, allowing them to restructure debt Chapter 11 and pursue a viable future.

Outcomes, Benefits, and Challenges of Chapter 11 Bankruptcy

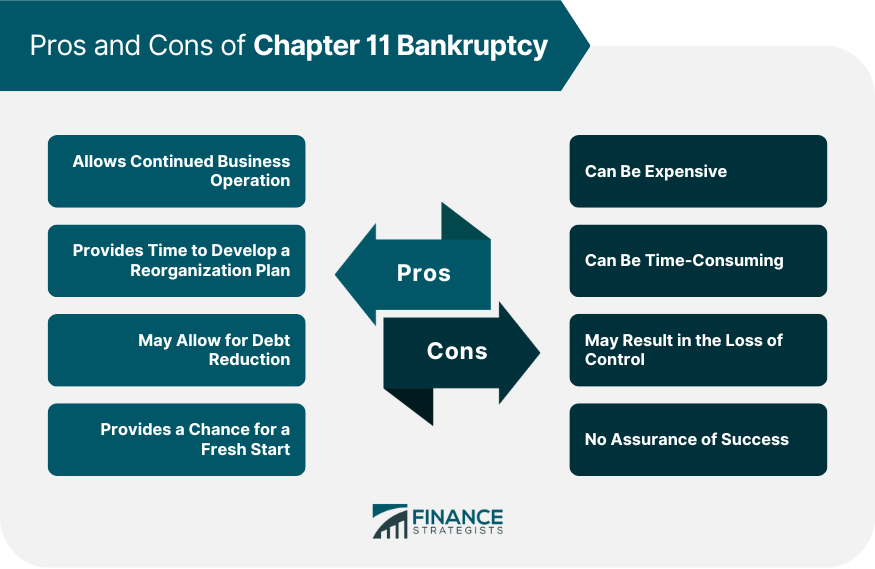

Successfully navigating Chapter 11 bankruptcy can lead to significant Chapter 11 benefits for a business, allowing it to survive and thrive. However, the process is not without its inherent Chapter 11 challenges and risks. Understanding these potential outcomes is crucial when considering what is Chapter 11 Bankruptcies and whether it is the right course of action.

1. https://tamtho.com.vn/mmoga-facing-overwhelming-debt-why-you-need-a-lawyer-for-bankruptcies/

4. https://tamtho.com.vn/mmoga-exploring-aws-cloud-computing-the-worlds-leading-cloud-platform/

5. https://tamtho.com.vn/mmoga-understanding-the-landscape-what-are-the-3-types-of-bankruptcies/

The Potential Advantages: Key Chapter 11 Benefits for Businesses

For a business facing insolvency but with a viable operational core, Chapter 11 bankruptcy offers several significant Chapter 11 benefits that are not available in liquidation bankruptcy.

One of the most important Chapter 11 benefits is the ability to continue operating the business. As a debtor in possession, the business can keep its doors open, continue serving customers, and employ staff while working through the restructuring process. This prevents the immediate loss of jobs and economic activity associated with liquidation.

Chapter 11 provides powerful tools to restructure debt Chapter 11. The debtor can negotiate with secured creditors to potentially modify loan terms or the value of collateral. It can also significantly reduce or eliminate unsecured debt through the reorganization plan. This restructuring allows the business to emerge with a more manageable debt load. Furthermore, Chapter 11 allows the debtor to assume or reject executory contracts and unexpired leases. This means the business can continue beneficial contracts (like favorable leases or supply agreements) and reject burdensome or unprofitable ones without facing immediate breach of contract lawsuits, providing crucial flexibility in restructuring operations.

Other Chapter 11 benefits include the ability to obtain new financing (“debtor-in-possession financing” or DIP financing) to fund operations during the bankruptcy case, the ability to sell assets outside the ordinary course of business free and clear of liens (with court approval), and the potential to resolve complex litigation or disputes within the bankruptcy framework. Successfully emerging from Chapter 11 bankruptcy allows the business to achieve a financial fresh start, shed unsustainable obligations, and pursue a viable future, often preserving jobs and economic contributions. These Chapter 11 benefits make it a crucial tool for business bankruptcy Chapter 11.

While Chapter 11 bankruptcy offers significant advantages, it is a highly complex, time-consuming, and expensive undertaking with substantial Chapter 11 challenges and risks. It is not a guaranteed path to success.

One of the major Chapter 11 challenges is the cost. Chapter 11 involves significant legal, accounting, and other professional fees incurred over the course of the case, which can last for a year or more. These costs can be substantial and add to the financial burden on the struggling business. The complexity of the legal requirements, including developing a confirmable Chapter 11 Plan of Reorganization and navigating court procedures, also presents a significant hurdle. The process requires extensive expertise and resources.

Successfully negotiating with multiple classes of creditors and gaining their acceptance of the plan can be challenging, as creditors often have competing interests and may object to the proposed treatment of their claims. The debtor must also demonstrate to the bankruptcy court that the plan is feasible and in the best interests of creditors. There is no guarantee that a plan will be confirmed; if a plan cannot be confirmed, the bankruptcy court may convert the case to a Chapter 7 liquidation or dismiss it entirely, potentially leading to the dissolution of the business.

The business must also manage the operational demands of continuing to run the company while undergoing the legal process of Chapter 11 bankruptcy, operating under court supervision and facing increased scrutiny from creditors and the U.S. Trustee. Failure to meet reporting requirements or effectively manage cash flow during the case can lead to complications or even the appointment of a trustee who takes control of the business. These significant Chapter 11 challenges and risks mean that Chapter 11 bankruptcy is only appropriate for businesses with a strong potential for future viability and the resources to navigate the complex process.

The Result: Discharge of Debt and Emerging from Chapter 11

If a Chapter 11 Plan of Reorganization is successfully confirmed by the bankruptcy court, the debtor business emerges from Chapter 11 bankruptcy. The confirmation order makes the plan legally binding on the debtor and all creditors.

Upon confirmation (or sometimes upon substantial consummation of the plan’s terms), the debtor receives a discharge of debt for most debts that arose before the date the Chapter 11 petition was filed. This discharge of debt legally releases the debtor business from personal liability for these pre-petition debts, except as otherwise provided for in the confirmed plan. The business then proceeds to implement the terms of the confirmed Chapter 11 Plan of Reorganization, making payments to creditors as outlined in the plan and operating according to the restructured framework.

Successfully emerging from Chapter 11 bankruptcy with a confirmed plan represents the achievement of the goal of reorganization. The business has restructured its balance sheet, potentially shed unsustainable debt, renegotiated contracts, and is operating under a new financial structure designed for future profitability. While the process is challenging, the ability to discharge of debt for qualifying liabilities and continue operations provides a crucial opportunity for a struggling business to gain a financial fresh start and pursue a viable future. This outcome is the ultimate Chapter 11 benefits sought by businesses undertaking business bankruptcy Chapter 11.

In conclusion, What is Chapter 11 Bankruptcies is a complex but powerful legal process under the Bankruptcy Code designed for businesses (and certain individuals) to reorganize their financial affairs while continuing to operate. The primary goal is to develop and confirm a viable Chapter 11 Plan of Reorganization to restructure debt Chapter 11 and emerge from bankruptcy as a healthier entity. The Chapter 11 process involves filing Chapter 11, operating as a debtor in possession under bankruptcy court supervision, negotiating with creditors, and navigating numerous legal requirements. The significant Chapter 11 benefits include continuing operations, restructuring debt, and assuming/rejecting contracts, leading to discharge of debt for qualifying liabilities upon plan confirmation. However, the process presents substantial Chapter 11 challenges related to cost, complexity, and the risk of conversion to liquidation. For a potentially viable business facing overwhelming debt, understanding what is Chapter 11 Bankruptcies is the critical first step in exploring this avenue for business bankruptcy Chapter 11 and the potential for a financial fresh start.