Facing overwhelming and unmanageable debt can be a debilitating experience, leaving individuals feeling trapped with no clear way forward. When debt burdens become insurmountable, the legal system in the United States offers a formal process under the Bankruptcy Code to provide relief and a chance for a financial fresh start. Among the various types of bankruptcy available, Chapter 7 bankruptcy is perhaps the most widely known and utilized by individuals seeking to quickly get rid of debt. Often referred to as liquidation bankruptcy, Chapter 7 bankruptcy is a powerful legal tool designed to discharge most unsecured debts, allowing debtors to clear their financial slate and begin rebuilding their lives. Understanding what is Chapter 7 Bankruptcies is the crucial first step for individuals buried under debt and exploring potential avenues for relief. It’s a specific legal procedure within the broader system of Bankruptcy Law aimed at providing a relatively swift resolution to financial distress. This comprehensive guide will delve into the core concepts of Chapter 7 bankruptcy, explaining its purpose, outlining who is typically eligible, detailing the Chapter 7 process from initial filing to final discharge of debt, and discussing the potential Chapter 7 benefits and Chapter 7 consequences associated with this specific type of bankruptcy. For those questioning what is Chapter 7 Bankruptcies and whether it might be a viable solution for their debt problems, this guide provides essential clarity.

Toc

Defining What is Chapter 7 Bankruptcies: The Path to Liquidation and Debt Discharge

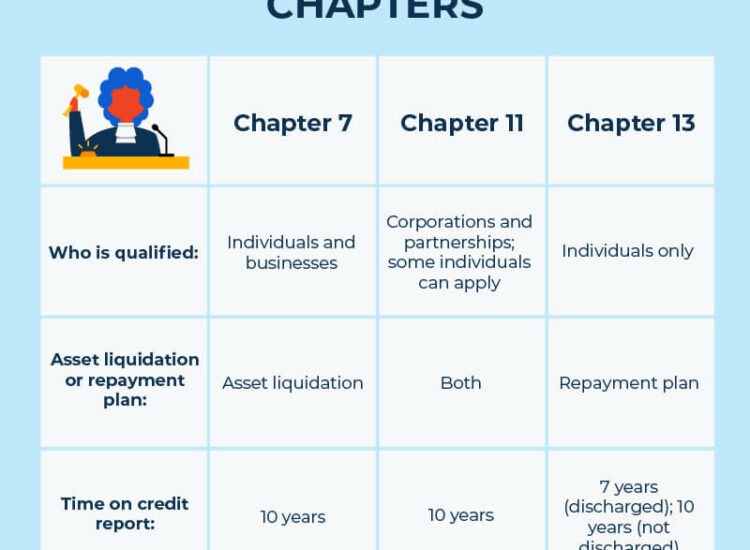

At its core, Chapter 7 bankruptcy provides a legal mechanism for individuals to eliminate most of their unsecured debts through a process overseen by a federal bankruptcy court. It is one of the defined types of bankruptcy available under the Bankruptcy Code, distinct from other chapters like Chapter 13 or Chapter 11 which involve repayment plans or reorganization. Understanding what is Chapter 7 Bankruptcies begins with grasping its fundamental concept and primary objective.

The Core Concept: Chapter 7 Bankruptcy Explained as a Type of Bankruptcy Case

Chapter 7 bankruptcy, as defined by the Bankruptcy Code, is a form of bankruptcy that involves the liquidation of a debtor’s non-exempt assets (if any) by a court-appointed trustee. The proceeds from the sale of these non-exempt assets are then distributed among the creditors according to a priority system established by Bankruptcy Law. However, it’s important to understand that in the vast majority of individual Chapter 7 bankruptcy cases, debtors are able to keep most, if not all, of their property because it is considered “exempt” under federal or state bankruptcy exemption laws. These exemptions allow debtors to protect certain essential assets like a portion of equity in their home, a vehicle, household goods, and retirement accounts.

So, while Chapter 7 bankruptcy is technically a liquidation process, for many individuals, it functions primarily as a way to get rid of debt without losing their essential possessions. It is a direct and relatively fast path to debt relief for individuals who do not have the income to repay a significant portion of their debts through a Chapter 13 plan and whose assets are largely protected by exemptions. When people refer to what is Chapter 7 Bankruptcies, they are typically referring to this specific legal procedure within the broader system of types of bankruptcy offered by the Bankruptcy Code, aimed at providing a swift financial fresh start through the discharge of debt. It is designed for individuals with limited or no ability to repay their debts over time.

The Primary Goal: Achieving Chapter 7 Debt Discharge for a Financial Fresh Start

The overarching and most significant goal of Chapter 7 bankruptcy is the discharge of debt. The discharge of debt is a legal order from the bankruptcy court that permanently releases the debtor from personal liability for certain qualifying debts. Once a debt is discharged in Chapter 7 bankruptcy, the debtor is no longer legally obligated to repay it, and creditors are prohibited from taking any further collection actions on that debt.

Debts that are typically dischargeable in Chapter 7 bankruptcy include:

- Unsecured debts such as credit card balances.

- Medical bills.

- Personal loans (unsecured).

- Deficiency balances on repossessed vehicles or foreclosed homes.

- Payday loans.

- Certain old tax debts.

However, it is crucial to understand that not all debts are dischargeable in Chapter 7 bankruptcy. Debts that are generally non-dischargeable include most tax debts (especially recent ones), child support, alimony, student loans (except in rare cases of proven undue hardship), debts for death or personal injury caused by operating a vehicle while intoxicated, and debts incurred through fraud or intentional wrongdoing. The Chapter 7 debt discharge applies only to debts that qualify for discharge under the Bankruptcy Code. Successfully achieving the Chapter 7 debt discharge is the ultimate outcome of the Chapter 7 process and is what provides the individual debtor with the core bankruptcy benefits and the opportunity for a financial fresh start, freeing them from the burden of overwhelming unsecured debt. Understanding what is Chapter 7 Bankruptcies hinges significantly on this concept of legally eliminating qualifying debts.

Who Typically Files: Understanding Chapter 7 Eligibility and the Means Test

Chapter 7 bankruptcy is not available to everyone facing financial difficulty. Eligibility for Chapter 7 bankruptcy is primarily determined by the debtor’s income and household size, evaluated through a tool known as the “means test.” The means test was introduced to the Bankruptcy Code to ensure that only debtors who truly lack the ability to repay a significant portion of their debts over time qualify for Chapter 7 liquidation.

The “means test” is a two-part test. First, it compares the debtor’s average monthly income for the six months before filing Chapter 7 to the median income for a household of the same size in their state. If the debtor’s income is below the state median, they generally pass this part of the test and are presumed eligible for Chapter 7 bankruptcy. If their income is above the state median, they must pass the second part of the test, which involves a more detailed calculation of their disposable income after deducting certain allowed expenses (such as housing, transportation, and health care costs). If the debtor’s disposable income, as calculated by the test, is below a certain threshold over a five-year period, they may still qualify for Chapter 7. However, if their disposable income is too high, they are presumed to have the ability to repay their debts and may be required to file under Chapter 13 bankruptcy instead, which involves a repayment plan.

1. https://tamtho.com.vn/mmoga-defining-what-is-chapter-11-bankruptcies-the-path-to-reorganization/

3. https://tamtho.com.vn/mmoga-exploring-aws-cloud-computing-the-worlds-leading-cloud-platform/

4. https://tamtho.com.vn/mmoga-facing-overwhelming-debt-why-you-need-a-lawyer-for-bankruptcies/

5. https://tamtho.com.vn/mmoga-understanding-the-landscape-what-are-the-3-types-of-bankruptcies/

Beyond the means test, there are other requirements for Chapter 7 eligibility. For instance, debtors must complete a mandatory credit counseling course from an approved provider within 180 days before filing Chapter 7. They must also not have had a bankruptcy case dismissed within the past 180 days under certain circumstances, and they must not have received a discharge of debt in a prior Chapter 7 case filed within the last 8 years or in a Chapter 13 case filed within the last 6 years (these look-back periods can vary depending on the specifics of the prior case). Generally, Chapter 7 bankruptcy is most suitable for individuals with primarily unsecured debt, limited income, and assets that are protected by exemptions, allowing them to qualify for the Chapter 7 debt discharge and a swift financial fresh start. Understanding what is Chapter 7 Bankruptcies involves recognizing these eligibility criteria.

Once it’s determined that Chapter 7 bankruptcy is the appropriate path and the debtor is eligible, the process follows a structured series of legal steps overseen by the bankruptcy court and a court-appointed trustee. While generally faster than other types of bankruptcy, the Chapter 7 process requires careful attention to detail and compliance with all legal requirements.

The Initial Steps: Preparing and Filing Chapter 7 Documentation

The Chapter 7 process formally begins with the debtor, often with the assistance of a bankruptcy lawyer, preparing and filing Chapter 7 bankruptcy petition and all required accompanying forms with the federal bankruptcy court. These documents are extensive and require comprehensive disclosure of the debtor’s financial life.

The required documentation typically includes:

- The bankruptcy petition itself, stating the chapter being filed under.

- Schedules listing all assets (real estate, vehicles, bank accounts, personal property, etc.) and their estimated values.

- Schedules listing all creditors and the amount owed to each.

- Schedules detailing current income and expenses.

- A statement of financial affairs, providing information about the debtor’s recent financial history, including income for the past two years, prior addresses, lawsuits, foreclosures, repossessions, and property transfers.

- Copies of recent pay stubs and tax returns.

- A certificate of completion for the mandatory credit counseling course.

- The results of the means test calculation, if applicable.

All documentation must be completed accurately and completely under penalty of perjury. Errors or omissions can lead to significant complications, including demands for additional information from the trustee, delays in the Chapter 7 process, or potentially the denial of the discharge of debt. Filing Chapter 7 correctly is a critical step, and the complexity of the required forms is a primary reason why individuals often seek the assistance of a bankruptcy lawyer to navigate this initial phase of the Chapter 7 process effectively.

The Role of the Chapter 7 Trustee and the Meeting of Creditors

A central figure in the Chapter 7 process is the court-appointed Chapter 7 trustee. The trustee is an impartial third party responsible for administering the bankruptcy estate. Their primary duties include reviewing the debtor’s bankruptcy petition and schedules, identifying any non-exempt assets, and if non-exempt assets exist, collecting and selling them to distribute the proceeds to creditors. The trustee also has the authority to investigate the debtor’s financial affairs for potential fraud or misuse of the bankruptcy system.

A mandatory step in the Chapter 7 process is the meeting of creditors, also known as the Section 341 meeting. This meeting is usually held about a month after filing Chapter 7 and is typically brief. The debtor is required to attend and answer questions under oath from the Chapter 7 trustee regarding their bankruptcy petition, schedules, and financial situation. Creditors are also invited to attend the meeting and ask questions, but they rarely appear in most consumer Chapter 7 cases unless they have specific concerns about a debt or the debtor’s assets. The Chapter 7 trustee uses this meeting to verify the information in the bankruptcy filing, ask clarifying questions about assets and debts, and determine if there are any non-exempt assets that could be liquidated. Attending the meeting of creditors with a bankruptcy lawyer is highly recommended, as the lawyer can prepare the debtor for the types of questions the trustee may ask and provide legal guidance during the meeting, ensuring the Chapter 7 process proceeds smoothly.

Asset Liquidation vs. Exemptions: What Happens to Your Property in Chapter 7 Bankruptcy

A key aspect of understanding what is Chapter 7 Bankruptcies is the concept of asset liquidation and the role of exemptions. While Chapter 7 bankruptcy is a liquidation bankruptcy, many individuals worry about losing all their possessions. However, Bankruptcy Law includes provisions that allow debtors to protect certain assets through exemptions.

Federal bankruptcy exemptions are a set of laws that specify certain types of property that a debtor can keep when filing Chapter 7, up to a certain value. In many states, debtors can choose to use either the federal exemptions or their state’s specific set of bankruptcy exemptions, whichever allows them to protect more property. Some states, however, require debtors to use only the state exemptions. Exempt property typically includes:

- A portion of equity in a primary residence (homestead exemption).

- A portion of equity in a vehicle.

- Household goods and furnishings up to a certain value.

- Tools of the trade (property used for work) up to a certain value.

- Retirement accounts (like 401(k)s and IRAs).

- Public benefits.

A bankruptcy lawyer is crucial in helping a debtor identify and claim all eligible exemptions to protect as much of their property as possible in Chapter 7 bankruptcy. In cases where a debtor has non-exempt assets with significant value (meaning the value exceeds the available exemption amount), the Chapter 7 trustee has the right to seize and sell that non-exempt property to distribute the proceeds to creditors. However, as mentioned earlier, the majority of individual Chapter 7 bankruptcy cases are “no-asset” cases because the debtor’s property is entirely covered by exemptions, and there is nothing for the trustee to liquidate. Understanding the interplay between asset liquidation and exemptions is vital to grasping the practical outcome of property ownership in the Chapter 7 process.

Outcomes and Considerations of Chapter 7 Bankruptcy

Successfully navigating the Chapter 7 process leads to specific outcomes, primarily the discharge of debt. However, it’s important to understand both the significant Chapter 7 benefits and the potential Chapter 7 consequences associated with this type of bankruptcy. Deciding if Chapter 7 bankruptcy is the right option requires carefully weighing these factors.

1. https://tamtho.com.vn/mmoga-facing-overwhelming-debt-why-you-need-a-lawyer-for-bankruptcies/

4. https://tamtho.com.vn/mmoga-defining-what-is-chapter-11-bankruptcies-the-path-to-reorganization/

5. https://tamtho.com.vn/mmoga-understanding-the-landscape-what-are-the-3-types-of-bankruptcies/

The Ultimate Result: The Discharge of Debt in Chapter 7 Bankruptcy

The ultimate and most impactful result of a successful Chapter 7 bankruptcy case is the discharge of debt. This legal order is issued by the bankruptcy court and signifies the debtor’s release from personal liability for most unsecured debts.

The Chapter 7 debt discharge means that creditors whose debts are discharged are permanently prohibited from taking any further action to collect those debts from the debtor. This includes contacting the debtor, filing lawsuits, attempting wage garnishment, or any other collection efforts. The Chapter 7 debt discharge provides a clean slate for the debtor regarding the discharged debts, allowing them to move forward without the burden of those financial obligations. This is the core of the debt relief provided by Chapter 7 bankruptcy. The timing of the discharge of debt in Chapter 7 bankruptcy is relatively quick compared to Chapter 13; assuming the debtor attends the meeting of creditors and completes the required financial management course, the discharge is typically granted about 60-90 days after the meeting of creditors. This rapid discharge of debt is one of the primary Chapter 7 benefits and enables a relatively swift financial fresh start. Understanding what is Chapter 7 Bankruptcies is largely about recognizing this powerful outcome of legally eliminating overwhelming debt.

Potential Chapter 7 Benefits and Chapter 7 Consequences

Considering Chapter 7 bankruptcy requires a realistic assessment of both the advantages it offers and the potential negative impacts.

The most significant Chapter 7 benefits include:

- Rapid Debt Discharge: Provides a relatively quick path to get rid of debt compared to Chapter 13.

- Elimination of Most Unsecured Debt: Discharges qualifying debts like credit cards, medical bills, and personal loans, offering substantial debt relief.

- Automatic Stay Protection: Offers immediate protection from most creditor collection actions upon filing.

- Ability to Keep Exempt Assets: Allows debtors to retain essential property within exemption limits.

However, potential Chapter 7 consequences include:

- Impact on Credit Score: Chapter 7 bankruptcy has a significant negative impact on the debtor’s credit score and can remain on their credit report for up to 10 years, making it harder to obtain future credit.

- Potential Loss of Non-Exempt Assets: While most cases are no-asset, debtors with significant non-exempt property could lose those assets to the trustee.

- Public Record: The bankruptcy filing is a public record.

- Doesn’t Discharge All Debts: Certain debts (like most taxes, student loans, child support) are typically not eliminated.

- Not Suitable for Debtors Who Can Repay: If the means test shows the debtor has the ability to repay, they may be required to file Chapter 13 instead.

Weighing these Chapter 7 benefits against the potential Chapter 7 consequences is a critical part of deciding if Chapter 7 bankruptcy is the right solution for a debtor’s specific financial situation. For many individuals overwhelmed by debt with limited assets, the Chapter 7 benefits of debt relief and a financial fresh start outweigh the negative impacts.

Alternatives and Getting Help: Is Chapter 7 Bankruptcy Right for You?

Deciding to file Chapter 7 is a major legal decision that should not be made lightly. It’s important to consider alternatives and, crucially, seek professional guidance.

Alternatives to Chapter 7 bankruptcy might include:

- Chapter 13 Bankruptcy: If income is too high for Chapter 7 or if the debtor wants to catch up on secured debts and keep non-exempt assets, Chapter 13 offers a repayment plan over 3-5 years, leading to a discharge of debt for remaining dischargeable debts.

- Debt Settlement: Negotiating with creditors to pay a reduced lump sum to settle debts. This can impact credit and doesn’t stop lawsuits or garnishments unless an agreement is reached.

- Debt Consolidation: Combining multiple debts into a single loan or payment plan. This might lower the interest rate or monthly payment but doesn’t reduce the principal owed.

- Doing Nothing: This is generally the worst option, leading to continued creditor harassment, potential lawsuits, wage garnishment, and asset seizure without legal protection or debt relief.

Given the complexities of Bankruptcy Law, the specific requirements for Chapter 7 eligibility and the means test, the intricacies of the Chapter 7 process, and the significant Chapter 7 benefits and Chapter 7 consequences, seeking advice from a qualified bankruptcy lawyer is strongly recommended. A bankruptcy lawyer can evaluate your situation, explain what is Chapter 7 Bankruptcies in relation to your circumstances, determine if you are eligible, discuss the potential outcome for your assets and debts, and advise you on whether Chapter 7 bankruptcy or an alternative is the best path to achieve debt relief and a financial fresh start. They can navigate the legal system, prepare accurate filings, and guide you through the Chapter 7 process to maximize your chances of obtaining a successful discharge of debt. For anyone struggling with overwhelming debt and asking what is Chapter 7 Bankruptcies, consulting with a bankruptcy lawyer is the most important step.

In conclusion, What is Chapter 7 Bankruptcies is a specific type of bankruptcy case under the Bankruptcy Code designed for individuals with unmanageable unsecured debt who qualify based on the means test. The Chapter 7 process involves filing Chapter 7 documentation, interacting with a Chapter 7 trustee, and potentially liquidating non-exempt assets, culminating in the Chapter 7 debt discharge for qualifying debts. The significant Chapter 7 benefits include rapid debt relief and a financial fresh start via discharge of debt, along with the protection of the automatic stay. However, potential Chapter 7 consequences like impact on credit and potential asset loss must be considered. Understanding what is Chapter 7 Bankruptcies is crucial for individuals seeking to get rid of debt, and consulting with a qualified bankruptcy lawyer is essential to navigate the complexities, determine Chapter 7 eligibility, and successfully complete the Chapter 7 process to achieve the intended financial fresh start.