The crushing weight of insurmountable debt can feel like an inescapable burden. Creditor calls, looming deadlines, potential lawsuits, and the constant stress of financial instability can make simply facing each day a challenge. For individuals and businesses alike who find themselves unable to meet their financial obligations, the legal option of bankruptcy offers a potential lifeline, a structured pathway towards resolving overwhelming debt and achieving a financial fresh start. However, navigating the complex legal system surrounding bankruptcy is far from simple. The intricate rules of the Bankruptcy Code, the specific procedures of the bankruptcy court, and the myriad requirements for filing bankruptcy necessitate specialized expertise. This is precisely where a dedicated professional becomes indispensable: a Lawyer for Bankruptcies. A Lawyer for Bankruptcies, often referred to as a bankruptcy lawyer or bankruptcy attorney, is a legal specialist whose entire practice is focused on guiding debtors through the intricate bankruptcy process. They possess the knowledge and experience to help clients understand their options, protect their rights, and effectively utilize Bankruptcy Law to gain debt relief. Facing financial collapse alone is daunting; securing the representation of a skilled Lawyer for Bankruptcies transforms this challenging process into a guided journey toward a more stable financial future. This extensive guide will delve into the vital role played by a Lawyer for Bankruptcies, explaining precisely what they do, detailing why their expertise is crucial when dealing with bankruptcies, outlining how they assist clients throughout the bankruptcy process for different types of bankruptcy, and discussing the practical aspects of working with and finding the right Lawyer for Bankruptcies to achieve the desired debt relief and financial fresh start.

Toc

Facing Overwhelming Debt? Why You Need a Lawyer for Bankruptcies

When debt becomes unmanageable, the stress can be paralyzing. Knowing that legal options exist through Bankruptcy Law is the first step, but understanding how to access them and navigate the complex system is where the expertise of a professional becomes paramount. A Lawyer for Bankruptcies is the key to unlocking these legal solutions effectively and safely.

Understanding the Role: What a Lawyer for Bankruptcies Does

A Lawyer for Bankruptcies is a legal expert who specializes in representing individuals and businesses in cases filed under the federal Bankruptcy Code in bankruptcy court. Their role is comprehensive, acting as the client’s advocate, advisor, and representative throughout the entire bankruptcy process. The term “Bankruptcies” in their title reflects that they handle various types of bankruptcy cases (personal, business) and multiple instances of clients facing such situations.

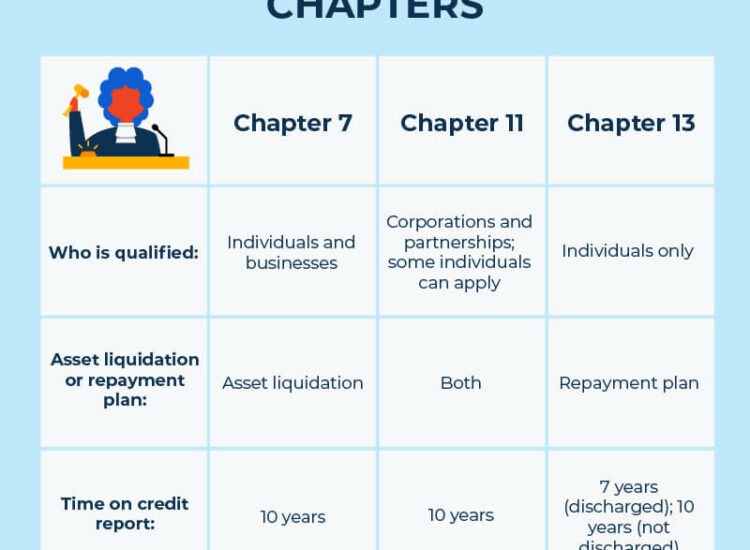

The responsibilities of a Lawyer for Bankruptcies begin with a thorough, confidential consultation to evaluate the client’s unique financial situation. This involves analyzing assets, liabilities, income, expenses, and the types of debts owed. Based on this detailed assessment, the bankruptcy lawyer provides expert advice on whether bankruptcy is the most appropriate course of action compared to other debt relief options (like debt settlement or consolidation). If bankruptcy is recommended, the Lawyer for Bankruptcies advises the client on which chapter of the Bankruptcy Code (such as Chapter 7, Chapter 13, or Chapter 11) is best suited to their specific circumstances and goals, explaining the pros and cons of each.

Once a chapter is selected, the Lawyer for Bankruptcies takes charge of the meticulous process of preparing and filing the official bankruptcy petition and all required supporting documents with the bankruptcy court. These documents require precise and complete disclosure of the client’s financial status, and any errors can have severe consequences. The lawyer ensures these complex filings comply with the strict rules of the Bankruptcy Code and local court procedures. Throughout the subsequent bankruptcy process, the Lawyer for Bankruptcies manages communication with the court, the court-appointed trustee, and the client’s creditors, represents the client at scheduled hearings (like the meeting of creditors), addresses any legal issues or objections that arise, and guides the client through fulfilling all requirements necessary to achieve the ultimate goal: the discharge of debt and a financial fresh start. Their work provides both legal protection and peace of mind for the client.

The Complexity Barrier: Why Legal Expertise is Essential for Filing Bankruptcy

Attempting the process of filing bankruptcy without the guidance of a qualified Lawyer for Bankruptcies presents a significant challenge due to the inherent complexity and technical nature of Bankruptcy Law. The Bankruptcy Code is a lengthy and detailed body of federal law, complemented by federal rules of bankruptcy procedure and specific local rules adopted by each bankruptcy court. Navigating these layers of regulations requires specialized legal expertise that the average individual or business owner is unlikely to possess.

One major barrier is the sheer volume and intricacy of the required documentation for filing bankruptcy. The petition and schedules require accurate listing of all assets, debts, income sources, and recent financial transactions, often spanning many pages. Misclassifying assets, failing to disclose all debts, or making errors in income/expense calculations can lead to delays, requests for additional information from the trustee, or potentially more serious issues, including accusations of bankruptcy fraud (which can result in denial of discharge of debt or even criminal penalties). A Lawyer for Bankruptcies understands exactly how these forms must be completed to comply with the Bankruptcy Code and to accurately reflect the debtor’s financial situation, minimizing the risk of critical errors.

Furthermore, the bankruptcy process involves specific legal procedures and timelines that must be strictly followed. Missing deadlines, failing to appear at scheduled hearings (like the meeting of creditors), or not responding properly to motions filed by creditors or the trustee can lead to the dismissal of the bankruptcy case, leaving the debtor without the desired debt relief and having wasted time, effort, and filing fees. A Lawyer for Bankruptcies manages these procedural requirements, ensuring all steps are taken correctly and on time. They are also equipped to handle more complex legal challenges that might arise during bankruptcies, such as creditors filing objections to the discharge of a specific debt, or the trustee raising concerns about asset exemptions or prior financial transactions. These “adversary proceedings” are essentially lawsuits within the bankruptcy case and require skilled legal advocacy that a non-lawyer simply cannot provide. The complexity barrier highlights why securing the representation of a Lawyer for Bankruptcies is not a luxury, but a necessity for a successful outcome.

Immediate Relief: How Your Lawyer for Bankruptcies Secures the Automatic Stay

One of the most powerful and immediate bankruptcy benefits obtained by filing bankruptcy is the implementation of the automatic stay. This legal injunction provides crucial immediate debt relief by halting most collection actions. Your Lawyer for Bankruptcies understands the urgency of securing this protection and acts quickly to initiate the process.

1. https://tamtho.com.vn/mmoga-defining-what-is-chapter-11-bankruptcies-the-path-to-reorganization/

4. https://tamtho.com.vn/mmoga-exploring-aws-cloud-computing-the-worlds-leading-cloud-platform/

5. https://tamtho.com.vn/mmoga-understanding-the-landscape-what-are-the-3-types-of-bankruptcies/

The moment your Lawyer for Bankruptcies electronically files your bankruptcy petition with the bankruptcy court, the automatic stay automatically goes into effect by operation of law. This happens instantly upon filing. Your Lawyer for Bankruptcies will then ensure that your creditors receive prompt notice of the bankruptcy filing, informing them that the automatic stay is in place and they are legally prohibited from continuing collection efforts.

The automatic stay immediately stops a wide range of actions that creditors might pursue, including:

- Pursuing or continuing lawsuits to collect debts.

- Initiating or continuing foreclosure proceedings on real estate.

- Repossessing vehicles or other secured property.

- Garnishing wages from your employer or funds from your bank account.

- Calling, writing, or otherwise contacting you to demand payment.

- Actions to enforce judgments.

This immediate cessation of collection activity provides debtors with essential breathing space to navigate the rest of the bankruptcy process without the constant pressure and stress of creditor harassment. If a creditor knowingly violates the automatic stay after receiving notice of the bankruptcy filing, your Lawyer for Bankruptcies can file a motion with the bankruptcy court to enforce the stay and may even seek damages or attorney’s fees against the creditor for the violation. The ability of your Lawyer for Bankruptcies to quickly file your case and secure this immediate legal protection is a critical component of the debt relief provided by Bankruptcy Law and underscores the value of having skilled legal counsel from the very beginning of your journey towards a financial fresh start.

The Expertise of a Lawyer for Bankruptcies in Different Types of Bankruptcy

A Lawyer for Bankruptcies possesses specialized knowledge tailored to the requirements and procedures of each chapter of the Bankruptcy Code. Their expertise varies depending on whether they are assisting individuals seeking a financial fresh start or businesses undergoing complex reorganization. Understanding how a Lawyer for Bankruptcies operates within different types of bankruptcy cases highlights their versatility and specialized skill set in handling various bankruptcies.

Guiding Individuals Through Chapter 7 and Chapter 13 with Legal Skill

The majority of cases handled by a Lawyer for Bankruptcies involve individuals filing under Chapter 7 or Chapter 13 of the Bankruptcy Code. While both offer debt relief, the process and the lawyer’s focus differ significantly.

For individuals pursuing Chapter 7 bankruptcy, often seeking a rapid discharge of debt through liquidation, the Lawyer for Bankruptcies plays a crucial role in eligibility assessment and asset protection. The lawyer helps the client navigate the potentially confusing “means test” to determine if their income level qualifies them for Chapter 7. They also meticulously review the client’s assets and debts to identify which assets can be protected using federal or state bankruptcy exemptions. A skilled Chapter 7 lawyer understands the nuances of exemption laws and works to maximize the amount of property the client can keep. They prepare all necessary documentation accurately, accompany the client to the meeting of creditors (a potentially nerve-wracking experience that is much smoother with legal representation), and address any questions or concerns raised by the Chapter 7 trustee. Their goal is to efficiently guide the client through the bankruptcy process towards obtaining a full discharge of debt for eligible liabilities, clearing the path for a financial fresh start.

For individuals filing under Chapter 13 bankruptcy, often seeking to repay some debt through a court-supervised plan, the Lawyer for Bankruptcies acts as a financial strategist and negotiator. A Chapter 13 lawyer works closely with the client to develop a feasible repayment plan that complies with the complex rules of the Bankruptcy Code and the requirements of the local bankruptcy court. This involves calculating disposable income, determining how various types of debt will be treated, and proposing a payment structure over three to five years. The lawyer represents the client at the plan confirmation hearing, addressing objections from creditors or the trustee and negotiating modifications if necessary to get the plan approved by the judge. Throughout the lifespan of the Chapter 13 plan, the lawyer provides ongoing support and guidance, helping the client navigate potential issues that arise and ensuring they meet the requirements to receive the discharge of debt upon successful completion of the plan, ultimately achieving their financial fresh start after fulfilling their plan obligations. The expertise of a Lawyer for Bankruptcies is vital in both these individual bankruptcy pathways.

Restructuring Businesses: The Role of a Lawyer for Bankruptcies in Chapter 11 Cases

Chapter 11 bankruptcy is the primary tool under the Bankruptcy Code for businesses seeking to reorganize their debts and continue operating. These cases are significantly more complex and expensive than consumer bankruptcies, requiring the sophisticated expertise of a Lawyer for Bankruptcies specializing in corporate reorganizations.

In a Chapter 11 case, the Lawyer for Bankruptcies (often leading a legal team) guides the debtor business through a lengthy and multifaceted bankruptcy process. This involves developing a comprehensive plan of reorganization that outlines how the business will restructure its debts, operate going forward, and propose payments to different classes of creditors. The Chapter 11 lawyer engages in extensive negotiations with creditors, creditor committees, and the U.S. Trustee to gain support for the proposed plan.

The Lawyer for Bankruptcies handles all legal aspects of the case, including preparing and filing complex court documents, representing the business at numerous court hearings on various motions (e.g., related to asset sales, financing, contracts), and defending the business against potential objections or adversary proceedings. A key part of their role is guiding the business through the legal requirements to get the plan of reorganization confirmed by the bankruptcy court. Successfully navigating Chapter 11 with a Lawyer for Bankruptcies allows the business to shed unsustainable debt burdens, restructure its operations for profitability, and emerge from bankruptcy as a healthier entity, preserving jobs and achieving a financial fresh start for the enterprise itself. The intricate legal requirements and high stakes of Chapter 11 underscore why a highly experienced Lawyer for Bankruptcies is indispensable for businesses pursuing this form of debt relief.

The foundation of a Lawyer for Bankruptcies’ effectiveness is their mastery of the Bankruptcy Code and their familiarity with the specific procedures of the bankruptcy court where the case is filed. While the Bankruptcy Code provides the overarching federal law, each bankruptcy court has its own local rules that dictate specific filing requirements, deadlines, and hearing procedures.

A skilled Lawyer for Bankruptcies possesses a deep understanding of the substantive provisions of the Bankruptcy Code, including:

2. https://tamtho.com.vn/mmoga-exploring-aws-cloud-computing-the-worlds-leading-cloud-platform/

4. https://tamtho.com.vn/mmoga-defining-what-is-chapter-11-bankruptcies-the-path-to-reorganization/

5. https://tamtho.com.vn/mmoga-understanding-the-landscape-what-are-the-3-types-of-bankruptcies/

- The eligibility criteria unique to each chapter (bankruptcy chapters 7, 11, 13).

- Which debts are legally dischargeable and which are not (discharge of debt).

- The scope and limitations of the automatic stay.

- Federal bankruptcy exemptions and how they interact with state exemption laws.

- The powers and duties of the bankruptcy trustee.

- The process for valuing assets and resolving secured debts.

- The detailed requirements for repayment or reorganization plans.

Beyond the federal statute, a competent Lawyer for Bankruptcies is intimately familiar with the local rules and practices of the specific bankruptcy court in the client’s jurisdiction. This knowledge is essential for ensuring all filings are compliant, deadlines are met, and the bankruptcy process proceeds smoothly. For example, the format for certain documents, procedures for requesting hearings, or specific requirements for the meeting of creditors can vary slightly between courts. A Lawyer for Bankruptcies knows these nuances, preventing costly errors or delays that can arise from non-compliance. Their dual understanding of the federal Bankruptcy Code and local court procedures is what empowers them to effectively represent clients and navigate the complex legal system to achieve debt relief and a financial fresh start.

Working with Your Lawyer for Bankruptcies: Process, Costs, and Finding Help

Engaging a Lawyer for Bankruptcies is a proactive step towards addressing overwhelming debt. Understanding what the working relationship entails, considering the costs involved, and knowing how to find the right attorney are crucial parts of this journey. The support of a qualified Lawyer for Bankruptcies can significantly improve the outcome of your bankruptcy process.

The Step-by-Step Bankruptcy Process Under the Guidance of a Lawyer for Bankruptcies

Working with a Lawyer for Bankruptcies structures the often-confusing bankruptcy process into a clear series of steps for the client. The lawyer handles the complexities, guiding the client through each phase.

- Initial Consultation and Evaluation: The process begins with the client meeting the Lawyer for Bankruptcies to discuss their financial situation, review options, and determine the most appropriate chapter under the Bankruptcy Code.

- Information Gathering: The lawyer provides the client with a checklist of necessary financial documents (pay stubs, tax returns, bank statements, creditor lists, etc.) required to prepare the bankruptcy petition. The lawyer assists in organizing and understanding this information.

- Petition and Schedule Preparation: The Lawyer for Bankruptcies drafts the complex official bankruptcy forms based on the client’s information, ensuring accuracy and compliance with the Bankruptcy Code. They review these documents with the client before filing.

- Case Filing: The lawyer electronically files the completed petition and schedules with the bankruptcy court, initiating the bankruptcy process and triggering the automatic stay. They handle the payment of court filing fees or arrangements for installments.

- Mandatory Credit Counseling: The lawyer ensures the client completes the required pre-filing credit counseling course from an approved provider.

- Meeting of Creditors: The lawyer prepares the client for the meeting of creditors, explaining the process and types of questions. The Lawyer for Bankruptcies attends this meeting with the client, representing them before the trustee.

- Addressing Issues and Compliance: The lawyer handles communication with the trustee and creditors throughout the case, responding to information requests or objections. They ensure the client completes the mandatory post-filing financial management course before discharge of debt.

- Discharge or Plan Confirmation: The Lawyer for Bankruptcies guides the case towards the successful discharge of debt (Chapter 7) or the confirmation of the repayment/reorganization plan (Chapter 13, 11). They handle any necessary court filings or hearings related to these outcomes.

- Case Closure: The lawyer oversees the final administrative steps required by the bankruptcy court to close the case.

This structured approach managed by a Lawyer for Bankruptcies transforms the overwhelming task of filing bankruptcy into a navigable process aimed at achieving debt relief and a financial fresh start.

Understanding the Cost of a Lawyer for Bankruptcies

The cost of a lawyer for bankruptcies is a significant consideration for individuals and businesses already in financial distress. Legal fees for bankruptcy lawyers are influenced by several factors, but they represent an investment in navigating the complex legal system effectively.

The cost of a lawyer for bankruptcies typically varies based on:

- Bankruptcy Chapter: Chapter 7 cases generally have lower flat fees than Chapter 13 cases (which may have fees partly paid through the plan) or Chapter 11 cases (which have the highest and most complex fee structures, often hourly).

- Case Complexity: Cases involving significant assets, business ownership, complex debts, potential litigation (adversary proceedings), or complicated financial histories will require more legal work and thus incur a higher cost of a lawyer for bankruptcies.

- Geographic Location: Legal fees can differ based on the attorney’s location and the prevailing rates in that area.

- Lawyer’s Experience: Highly experienced or renowned Lawyers for Bankruptcies may charge higher fees reflective of their expertise.

It is crucial to discuss the cost of a lawyer for bankruptcies upfront during the initial consultation. Many bankruptcy lawyers offer free initial meetings to evaluate your case and provide an estimate of their fees and the total costs, including court filing fees. While there is an expense involved, comparing the cost of a lawyer for bankruptcies to the potential financial benefits of achieving debt relief, protecting assets, and avoiding costly mistakes in the bankruptcy process demonstrates the value of legal representation. For most clients, the expertise provided by a Lawyer for Bankruptcies is well worth the investment in achieving a financial fresh start.

Choosing the Right Lawyer for Bankruptcies to Achieve Debt Relief and a Financial Fresh Start

Selecting the most suitable Lawyer for Bankruptcies is a critical decision that can significantly impact the outcome of your case and your journey towards debt relief. Not all bankruptcy attorneys are equally qualified or the right fit for every client.

When choosing a Lawyer for Bankruptcies:

- Verify Specialization and Experience: Ensure the attorney focuses specifically on Bankruptcy Law and has substantial experience handling cases under the chapter you are considering (bankruptcy chapters 7, 13, or 11). Ask about their success rate and experience with cases similar to yours.

- Check Credentials: Confirm the lawyer is licensed to practice law in your jurisdiction and admitted to practice in federal bankruptcy court.

- Seek Referrals and Read Reviews: Ask for recommendations from trusted sources or look for online reviews for Lawyers for Bankruptcies in your area.

- Schedule Consultations: Meet with a few different bankruptcy attorneys for initial consultations. Use this as an opportunity to evaluate their knowledge, communication style, and approach to your case.

- Ask Specific Questions: During consultations, ask about their fees (cost of a lawyer for bankruptcies), how they handle communication, who will be working on your case, and what they see as the potential outcomes and challenges for your specific situation based on the Bankruptcy Code.

- Evaluate Comfort and Trust: Choose a Lawyer for Bankruptcies with whom you feel comfortable discussing sensitive financial details and who instills confidence in their ability to guide you through the bankruptcy process. Trust and open communication are vital for a successful working relationship.

Selecting the right Lawyer for Bankruptcies is an investment in securing your debt relief and paving the way for a financial fresh start. Their expertise is invaluable in navigating the complexities of Bankruptcy Law and the bankruptcy process, helping you achieve the most favorable outcome possible in bankruptcy court.

In conclusion, when facing the overwhelming burden of debt, a Lawyer for Bankruptcies is the essential guide through the legal system, providing the expertise needed to effectively file bankruptcy and gain debt relief. This specialized professional understands the intricacies of the Bankruptcy Code and the procedures of the bankruptcy court, assisting clients with different types of bankruptcy cases, including Chapter 7, Chapter 13, and Chapter 11. The Lawyer for Bankruptcies manages the entire bankruptcy process, from securing the immediate protection of the automatic stay to handling the meeting of creditors and working towards the discharge of debt or plan confirmation, ultimately aiming for a financial fresh start. While understanding the cost of a lawyer for bankruptcies is important, the value provided by a skilled bankruptcy attorney in navigating legal complexities, protecting assets, and achieving debt relief far outweighs the expense for most debtors. Choosing the right Lawyer for Bankruptcies is the critical step towards successfully utilizing Bankruptcy Law to overcome financial challenges and embark on the path to a more stable future.