Buying a new or used car is an exciting milestone, filled with anticipation for hitting the open road in your new ride. However, for most people, the process involves securing an auto loan, which can sometimes feel daunting. Understanding the true cost of financing, comparing different loan offers, and determining an affordable monthly payment are crucial steps that can significantly impact your budget for years to come. This is where the power of an Auto Loan Calculator comes into play. Far more than just a simple gadget, a reliable Auto Loan Calculator is an indispensable tool that empowers you to plan your budget, understand loan costs, and make informed decisions before you ever sign on the dotted line. It helps you calculate car loan scenarios with ease, providing clarity on key figures like your potential monthly payment, the total interest you’ll pay, and the overall total loan cost. Whether you’re exploring options online, preparing to negotiate with a lender, or simply trying to figure out how much car you can truly afford, mastering the use of an auto loan payment calculator is a critical step towards smart car financing. This comprehensive guide will walk you through everything you need to know about using an Auto Loan Calculator, explaining its benefits, how it works, and how to leverage its capabilities to secure the best possible deal on your next vehicle.

Toc

What is an Auto Loan Calculator and Why is it Essential for Car Buyers?

Before diving into the details of how to use one, let’s establish precisely what an Auto Loan Calculator is and why it has become such a fundamental tool for anyone considering financing a vehicle. Understanding its purpose is the first step to unlocking its full potential for planning and budgeting.

Defining the Auto Loan Calculator and Its Purpose

At its core, an Auto Loan Calculator is a digital tool designed to estimate the costs associated with borrowing money to purchase a car. It takes key information about a potential loan and performs the necessary calculations to provide you with insights into the financial implications of that loan. You input variables such as the total amount you need to borrow (the loan principal), the interest rate you expect to receive (car loan rates), and the length of time you will take to repay the loan (loan term). Some advanced versions might also include fields for sales tax, fees, down payment amount, and the value of any trade-in vehicle.

Based on these inputs, the Auto Loan Calculator computes and displays vital outputs. The most commonly sought-after figure is the estimated monthly payment. This tells you how much you would need to pay each month over the life of the loan. However, a good car loan calculator provides more than just the monthly amount; it also reveals the total interest you will pay over the entire loan term and the total loan cost (the sum of the principal and the total interest paid). Essentially, the purpose of an auto loan payment calculator is to demystify the loan process, turning complex interest calculations into clear, actionable figures that help you understand the financial commitment involved. It allows you to quickly and easily calculate car loan costs under different potential scenarios.

The Critical Benefits of Using a Car Loan Calculator Before You Buy

Using a car loan calculator is not just a good idea; it’s an essential step in the car buying process. The benefits of using a car loan calculator extend beyond simply knowing your monthly bill. They empower you to approach financing with confidence and control.

Firstly, a car loan calculator is invaluable for budgeting and planning. By inputting the price of the car you’re considering, your expected down payment, and potential car loan rates and loan terms, you can immediately see if the estimated monthly payment fits comfortably within your budget. This prevents you from falling in love with a car only to find out later that the payments are unmanageable. It helps you determine a realistic price range for your vehicle purchase based on your financial capacity. Knowing your estimated monthly payment upfront is a key benefit.

Secondly, using a car payment calculator gives you significant leverage in negotiations. If you know your target monthly payment and understand how different car loan rates and loan terms affect it, you can have informed conversations with lenders or dealerships. You won’t be solely reliant on the figures they provide; you can use the calculator to verify their offers and explore alternative scenarios that might be more favorable to you. This knowledge empowers you to negotiate better car loan rates or adjust the loan term strategically.

Thirdly, the calculator helps you avoid focusing solely on the monthly payment. While the monthly figure is important for cash flow, the total interest paid and the total loan cost reveal the true expense of borrowing. A seemingly low monthly payment might be achieved by stretching the loan term significantly, resulting in a much higher total interest paid over time. The auto loan calculator helps you visualize this trade-off, enabling you to make a decision based on both short-term affordability and long-term cost.

Finally, using an auto loan calculator brings peace of mind. Understanding the numbers involved reduces anxiety and builds confidence throughout the financing process. You feel more in control when you’ve done your homework and used a reliable auto loan payment calculator to explore various possibilities before committing to a loan. The benefits of using a car loan calculator are clear: better budgeting, stronger negotiation, clearer understanding of total cost, and increased confidence. It is truly an essential tool for any smart car buyer aiming to calculate car loan expenses accurately.

Comparing Car Loan Offers with Presentation

One of the most practical applications of an Auto Loan Calculator is in comparing different car loan offers you might receive from various lenders, such as banks, credit unions, or dealership financing departments. Offers can vary significantly in terms of car loan rates, fees, and available loan terms. Simply looking at the quoted interest rate isn’t enough; the loan term dramatically impacts the monthly payment and total interest.

To compare offers with precision using your auto loan calculator, input the exact details of each offer separately. For Offer A, input the principal loan amount, the offered car loan rate (APR is best, as it includes fees), and the proposed loan term. Note down the calculated monthly payment, total interest, and total loan cost. Repeat this process for Offer B, Offer C, and so on.

By doing this, you get a clear, side-by-side comparison of how each loan offer translates into real costs for you. You might find that a slightly higher interest rate from one lender results in a lower total interest paid because they offer a shorter loan term you can afford, thanks to a manageable calculated monthly payment. Conversely, a very low monthly payment offer might come with a much longer loan term and significantly higher total loan cost due to increased total interest. The auto loan calculator provides the data needed to make an objective decision about which offer provides the best value for your specific financial situation and goals. It transforms the opaque nature of loan offers into transparent, comparable figures, allowing you to confidently choose the best way to calculate car loan financing.

How to Use an Auto Loan Calculator and Interpret the Results

While the interfaces of different Auto Loan Calculator tools may vary slightly, the fundamental process of using them and interpreting the outputs remains largely the same. Understanding each input and what the calculated figures represent is key to leveraging the calculator effectively. Using a reliable car loan calculator involves more than just plugging in numbers; it’s about understanding what those numbers mean.

Understanding the Key Inputs for Calculating Your Loan

A good auto loan calculator requires specific inputs to accurately estimate your loan costs. Understanding each input field is crucial for getting meaningful results.

- Loan Amount: This is the total amount of money you need to borrow to buy the car. It’s typically the car’s purchase price minus your down payment and any trade-in value. Be sure to factor in sales tax and registration fees if they are being rolled into the loan. Inputting the correct principal amount is the first critical step to calculate car loan payments accurately.

- Down Payment: This is the amount of money you pay upfront towards the purchase price of the car. A larger down payment reduces the amount you need to borrow, which in turn lowers your monthly payment and the total interest paid over time. Inputting your planned down payment is essential for accurate calculation.

- Trade-in Value (if applicable): If you are trading in your old car, its value will be applied towards the purchase price, further reducing the loan amount needed. Input this figure if the calculator has the option.

- Car Loan Rates (Interest Rate or APR): This is arguably the most critical input. It represents the cost of borrowing money. Use the Annual Percentage Rate (APR) if available, as it includes certain fees beyond the simple interest rate, giving you a more accurate picture of the true borrowing cost. Even a small difference in car loan rates can have a significant impact on the monthly payment and total interest paid over a long loan term. It’s vital to use the most accurate rate you expect to receive.

- Loan Term (Loan Duration): This is the length of time, usually expressed in months (e.g., 36, 48, 60, 72, or even 84 months), over which you will repay the loan. A longer loan term will result in a lower monthly payment, making the car seem more affordable in the short term. However, it also means you pay interest for a longer period, significantly increasing the total interest paid and the total loan cost. This input is crucial for understanding the trade-off between monthly affordability and overall borrowing expense when you calculate car loan payments.

Inputting these values accurately into the auto loan calculator sets the stage for receiving reliable estimations of your loan costs.

Decoding the Outputs: From Monthly Payment to Total Loan Cost

Once you input the necessary information into the auto loan payment calculator, it processes the data and presents the results. Understanding what each output figure represents is key to making sense of your potential loan.

- Estimated Monthly Payment: This is the figure most people focus on. It’s the amount of principal and interest you would need to pay each month for the duration of the loan term. It gives you a clear picture of the immediate financial commitment. This figure is often the first point of comparison between different cars or loan offers when using a car payment calculator.

- Total Interest Paid: This figure represents the total amount of money you will pay in interest over the entire life of the loan, assuming you make all payments on time according to the schedule. This is the actual cost of borrowing the principal amount. Comparing the total interest paid for different loan terms or car loan rates highlights the long-term financial impact of your financing choices. A low monthly payment achieved with a long loan term will often show a much higher total interest figure.

- Total Loan Cost: This figure is the sum of the original loan principal amount and the total interest paid over the loan term. It represents the entire amount of money you will have paid back to the lender by the time the loan is fully repaid. This is the true final cost of financing the car. Comparing the total loan cost from different scenarios using the auto loan calculator provides the clearest picture of the overall financial burden. Focusing only on the monthly payment without considering the total loan cost can lead to overspending in the long run.

By analyzing these outputs from your car loan calculator, you gain a comprehensive understanding of the financial implications of a potential auto loan, allowing you to make decisions based on both immediate affordability (monthly payment) and long-term expense (total interest, total loan cost). Learning to decode these outputs is vital for anyone looking to calculate car loan costs effectively.

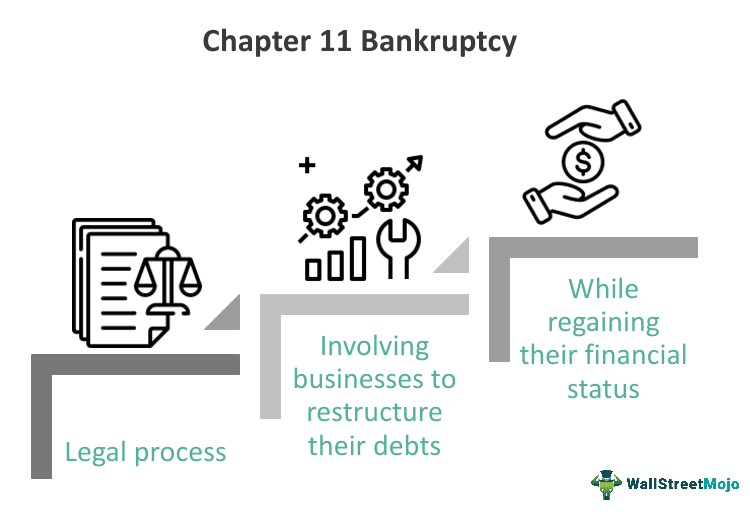

Exploring the Auto Loan Amortization Schedule

Beyond the summary outputs, many Auto Loan Calculator tools also provide an auto loan amortization schedule. This schedule offers a detailed breakdown of how each individual monthly payment is applied towards the principal loan amount and the interest owed over the entire loan term.

An auto loan amortization schedule typically shows each payment number, the date of the payment, the amount of the payment that goes towards interest, the amount that goes towards principal, the remaining balance after the payment is made, and often the cumulative interest paid up to that point.

Reviewing the auto loan amortization schedule provided by the car payment calculator offers valuable insights:

- You can see how, in the early stages of the loan term, a larger portion of your monthly payment is allocated towards paying off the interest.

- As you progress through the loan, a progressively larger portion of each monthly payment goes towards reducing the principal balance.

- The schedule clearly illustrates how extending the loan term means you spend a longer period paying off interest before making significant progress on the principal, resulting in a higher total interest paid.

Understanding the auto loan amortization process helps you see exactly how your payments are working and reinforces the financial impact of the loan term and car loan rates. It adds a layer of transparency that goes beyond the summary figures, helping you fully grasp the commitment when you calculate car loan payments.

Factors Influencing Your Loan and Maximizing the Use of Your Auto Loan Calculator

The results you get from an Auto Loan Calculator are estimates based on the inputs you provide. The actual car loan rates and terms you qualify for can be influenced by several external factors. Understanding these factors allows you to use the calculator more strategically and prepare effectively for applying for an auto loan.

Key Factors That Affect Your Car Loan Rates and Overall Cost

The interest rate you are offered on an auto loan is not arbitrary; it’s determined by several factors that lenders consider to assess their risk. These factors directly impact the inputs you’ll use in your auto loan calculator.

- Credit Score: This is arguably the single most important factor affecting your car loan rates. A higher credit score (generally above 700-750) indicates a lower risk to lenders, typically resulting in significantly lower interest rates. Conversely, a low credit score will often lead to much higher rates. Checking your credit score before applying for an auto loan is crucial for setting realistic expectations and for inputting an accurate estimated car loan rate into your calculator.

- Loan Term: As discussed, the length of the loan impacts the rate. Longer loan terms often come with slightly higher interest rates because the lender is taking on risk for a longer period. While a longer loan term lowers your monthly payment, it increases both the interest rate and the duration you pay interest, leading to a much higher total interest paid and total loan cost.

- Down Payment Amount: A larger down payment reduces the loan amount and lowers the lender’s risk. This can sometimes help you qualify for a better car loan rate. It also immediately reduces the amount you need to borrow, directly lowering the total interest and total loan cost.

- Vehicle Age and Type: Lenders may offer different rates for new cars versus used cars, and sometimes for specific types of vehicles they consider higher risk.

- Current Market Interest Rates: The overall economic climate and the prevailing interest rates set by central banks influence the rates offered on all types of loans, including auto loans. You can’t control this, but being aware helps understand the general range of car loan rates available.

- Lender Type: Different lenders (banks, credit unions, online lenders, dealership financing) may offer varying rates and terms. Credit unions, for example, are sometimes known for offering competitive car loan rates.

Understanding these factors allows you to potentially improve your loan terms (e.g., by improving your credit score) and to input the most likely car loan rates into your auto loan calculator for realistic planning.

Using the Car Payment Calculator to Model Different Scenarios

Once you understand the inputs and factors influencing them, the power of the car payment calculator truly shines in its ability to model different scenarios. This allows you to see the impact of various decisions before you make them.

Use your auto loan calculator to explore questions like:

- “If I increase my down payment by $1,000, how much lower will my monthly payment be, and how much total interest will I save?” (Input different down payment amounts with the same loan amount, rate, and term).

- “If I choose a 60-month loan term instead of 72 months, how much higher will my monthly payment be, but how much will I save on total interest?” (Input different loan terms with the same loan amount and rate).

- “If I qualify for a car loan rate of 5% APR instead of 6% APR, how much will that reduce my monthly payment and total interest over a 60-month loan term?” (Input different rates with the same loan amount and term).

- “What’s the maximum car price I can afford if I want my monthly payment to be no more than $400 over 60 months with an estimated 5% APR and a $3,000 down payment?” (This might require some trial and error, adjusting the loan amount until the monthly payment matches your target).

By modeling these scenarios, you gain valuable insights into the trade-offs involved in auto loan financing. You can identify which factors have the biggest impact on your monthly payment and total loan cost, empowering you to make strategic decisions tailored to your financial goals using your auto loan calculator.

Beyond the Calculator: Next Steps in Securing Your Auto Loan

While an Auto Loan Calculator is an essential tool for planning and comparison, it’s important to remember that the results are estimates. The actual terms of your loan will be determined by the lender based on your creditworthiness and the specific loan product. After using your auto loan calculator to explore scenarios and determine a comfortable budget range, here are the next steps:

- Get Pre-approved for a Loan: Apply for pre-approval with a few different lenders (banks, credit unions, online lenders). This will give you a solid understanding of the actual car loan rates and loan terms you qualify for before you go car shopping. You can then use these real numbers in your auto loan payment calculator for precise planning.

- Know Your Budget (Beyond the Payment): Use the auto loan calculator results as a starting point, but remember to factor in other costs of car ownership like insurance, registration, maintenance, and fuel into your overall budget.

- Compare Final Offers: Once you have firm loan offers, use your auto loan calculator one last time to compare them precisely, looking at the monthly payment, total interest, and total loan cost for each.

- Read the Fine Print: Carefully review the loan agreement before signing. Ensure the car loan rates, loan term, and all fees match the offer you accepted and the figures you calculated.

The Auto Loan Calculator is a powerful tool in your financial arsenal, helping you navigate the complexities of car financing with clarity and confidence. By understanding what is an auto loan calculator, how to use it effectively, and the factors that influence your results, you can make smarter decisions, secure better terms, and ultimately save money on your next vehicle purchase. Don’t skip this crucial step – use a reliable car loan calculator to plan your approach and drive away with confidence in your financing.