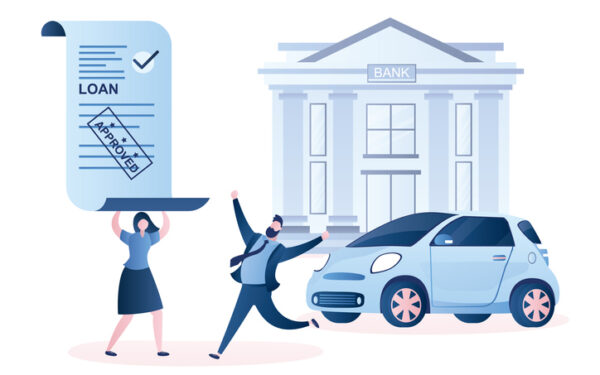

For countless vehicle owners, the journey to driving their desired car began with securing an auto loan. This initial financing agreement establishes the terms of borrowing, including the interest rate, the repayment schedule (known as the loan term), and the resulting monthly payment. However, the terms you agreed to at the time of purchase might not remain the most advantageous over the life of your loan. Market conditions change, personal financial health evolves, and new loan products become available. This is precisely where the strategic financial maneuver known as Auto Loan Refinancing becomes a powerful option. Auto Loan Refinancing involves obtaining a new loan to pay off your existing car loan, essentially replacing the old financing with a new agreement that ideally comes with more favorable terms. The primary objectives of Auto Loan Refinancing are typically to reduce the cost of borrowing by securing a lower interest rate, decrease the regular monthly payment to free up cash flow, or adjust the loan term to either pay off the loan faster or extend payments for greater flexibility. Considering Auto Loan Refinancing can be a smart way to save a significant amount of money over the remainder of your loan’s life and better align your vehicle financing with your current financial goals and capabilities. This comprehensive guide will delve deep into the world of Auto Loan Refinancing, explaining exactly what it entails, detailing the numerous benefits of auto loan refinance, outlining the typical refinancing process, exploring the key factors that influence your eligibility and new terms, and discussing when to consider auto loan refinancing for maximum impact. Whether you’re looking to understand how to refinance car loan or evaluating the potential savings with an auto loan refinancing calculator, this guide provides the essential information.

Toc

The Strategic Advantage of Auto Loan Refinancing: Unlocking Better Terms

At its core, Auto Loan Refinancing is a proactive financial strategy aimed at optimizing your vehicle financing after the initial purchase has been made. It offers a pathway to potentially improve the terms of your existing auto loan, leading to tangible financial benefits and greater control over your budget. Understanding the fundamental concept and the core motivations behind Auto Loan Refinancing is the first step towards leveraging its power.

What Auto Loan Refinancing Means: Replacing Your Current Car Loan

At its most basic level, Auto Loan Refinancing is the act of taking out a new car auto loan to pay off the outstanding balance on your current auto loan. Once the new loan is finalized, the funds are sent directly to your original lender, settling your old loan. You then begin making regular payments to the new lender under the terms of the refinanced loan agreement. This new agreement will have its own interest rate (car loan rates), loan term, and resulting monthly payment.

The intention behind Auto Loan Refinancing is always to improve upon the terms of the original loan. This could mean securing a lower interest rate than the one you currently have, which is often the primary driver for Auto Loan Refinancing. It could also mean changing the loan term – either extending it to reduce the monthly payment or shortening it to pay off the debt faster and reduce the total interest paid. Auto Loan Refinancing allows you to leverage improvements in your financial situation, changes in market interest rates, or simply to find a different lender with more competitive offerings or better customer service than your current one. It’s a deliberate decision to replace an existing financial obligation with a new one that is structured to be more advantageous based on current conditions. Effectively performing car loan refinancing means successfully securing this new, better loan to replace the old one.

Primary Motivations: Securing a Lower Interest Rate and Reducing Total Interest

The most compelling reason individuals pursue Auto Loan Refinancing is the potential to save money, primarily by obtaining a lower interest rate. The interest rate is the cost of borrowing money, expressed as a percentage of the loan principal. Over the loan term, the amount paid in interest can be substantial. Even a seemingly small reduction in the interest rate can translate into significant savings on the total interest paid over the life of the loan, especially on a large loan amount or a lengthy loan term.

For instance, if you have $20,000 remaining on a loan at 7% APR with 48 months left, and you refinance auto loan to a new loan at 5% APR over the same remaining 48 months, you could save a considerable amount on total interest over those four years. This direct reduction in borrowing costs is a key benefit of auto loan refinance. By lowering the lower interest rate, you decrease the portion of each monthly payment that goes towards interest, allowing more of your payment to go towards the principal, which accelerates the payoff process (assuming the term remains the same or is shortened) and reduces the overall total loan cost. The opportunity to significantly reduce the overall amount spent on interest makes Auto Loan Refinancing a very attractive financial strategy for many car owners. Quantifying this potential savings is a primary use for a refinance auto loan calculator.

Adjusting Your Payments: Achieving a Lower Monthly Payment or Shorter Loan Term

Beyond saving on total interest through a lower interest rate, Auto Loan Refinancing offers flexibility in adjusting your monthly payment and loan term, which can align your vehicle financing better with your current budgetary needs or financial goals.

One common goal when undergoing Auto Loan Refinancing is to achieve a lower monthly payment. This is particularly desirable if your current car payment is a strain on your budget or if you need to free up cash flow for other financial priorities. You can achieve a lower monthly payment in two main ways through Auto Loan Refinancing:

- Securing a lower interest rate: Even if you keep the same loan term, a lower interest rate will directly reduce the amount of interest accrued each month, thereby lowering the required monthly payment.

- Extending the loan term: By refinance car loan to a new loan with a longer repayment period than the remaining term on your current loan, you spread the outstanding balance over more months. This reduces the amount of principal you need to pay back each month, resulting in a lower monthly payment. However, it’s crucial to understand that while this helps with short-term cash flow, extending the loan term will increase the total interest paid over the life of the loan, ultimately increasing the total loan cost.

Conversely, if your financial situation has improved (e.g., increased income), you might consider Auto Loan Refinancing to shorten the loan term. By choosing a shorter repayment period than the remaining term of your current loan, your monthly payment will increase. However, you will pay off the loan faster and significantly reduce the amount of total interest paid, leading to a lower total loan cost. This strategy is ideal for those who prioritize becoming debt-free sooner and minimizing the overall borrowing expense. The ability to adjust the loan term and consequently your monthly payment is a significant benefit of auto loan refinance, providing valuable flexibility in managing your finances. Using a refinance auto loan calculator is essential for modeling these different scenarios.

Deciding that Auto Loan Refinancing is a potential strategy is just the first step. The next involves understanding and executing the typical refinancing process. While it may seem daunting, breaking it down into manageable steps makes it much easier to navigate. Successfully completing the refinancing process requires some preparation and careful evaluation of offers.

Essential Steps to Take Before Starting Auto Loan Refinancing

Before you begin actively applying for a new auto loan to pay off your old one, there are crucial preparatory steps that can significantly improve your outcome. This initial phase is vital for setting the stage for a successful refinancing process.

- Check Your Credit Score and Review Your Credit Report: Your credit score is the most important factor determining the car loan rates you will be offered on a refinance loan. Obtain your latest credit score and free credit reports from the major credit bureaus. Review your reports for any errors and dispute them if necessary. Knowing your current credit score helps you gauge the likelihood of qualifying for a significantly lower interest rate and allows you to target lenders who offer competitive rates for your credit tier. If your credit score has improved since your original loan, this is a strong indicator that Auto Loan Refinancing could be highly beneficial.

- Determine Your Car’s Current Value: Lenders will assess the value of your vehicle when considering a refinance loan. Use online valuation tools (like Kelley Blue Book or NADA Guides) to get an estimate of your car’s current market value (trade-in or private party value). This helps you understand your loan-to-value ratio (LTV) – the amount you owe compared to the car’s value. A favorable LTV improves your chances of approval and qualifying for better car loan rates.

- Gather Information About Your Current Loan: Have all the details of your existing auto loan readily available. This includes the current outstanding balance, the original interest rate, the remaining loan term, and the name of your current lender. This information is necessary for comparing your current situation to potential new loan offers and for completing the new loan application.

- Research Current Auto Loan Rates: Before applying, research the prevailing car loan rates being offered by various lenders for auto refinance. Look at rates from banks, credit unions, and online lenders. This gives you a benchmark for what constitutes a good offer based on your credit score and the current market. This research helps you set realistic expectations for the refinancing process.

Taking these preparatory steps ensures you are well-informed and prepared to find the best possible terms during the refinancing process for your car auto loan.

Applying for Your New Loan and Understanding Lender Evaluation

Once you’ve done your research and preparation, the next step in the refinancing process is to formally apply for a new auto loan. This involves submitting applications to the lenders whose research rates looked promising.

- Submit Applications: Complete loan applications with one or more lenders you’ve identified. Online lenders often have quick application processes. Be prepared to provide personal information, income details, employment history, and specifics about your current vehicle and loan. Each application will typically involve a hard inquiry on your credit report, which can slightly impact your credit score. Applying to multiple lenders within a short timeframe (usually 14-45 days, depending on the scoring model) will likely only count as one hard inquiry for scoring purposes, so it’s advisable to shop around within a focused period.

- Lender Evaluation: Lenders will evaluate your application based on several factors, including your credit score, credit history, income stability, debt-to-income ratio, and the loan-to-value ratio (LTV) of your vehicle. They assess these factors to determine your eligibility for a refinance loan and the car loan rates and loan term they are willing to offer you.

- Receive and Review Offers: If approved, you will receive loan offers detailing the proposed new interest rate (APR), the new loan term, and the resulting monthly payment. This is where your preparatory research and tools like a refinance auto loan calculator become invaluable for evaluating which offer provides the greatest benefits of auto loan refinance.

- Select the Best Offer: Carefully compare the offers received, focusing not just on the lower interest rate or lower monthly payment, but also on the total interest paid over the life of the new loan and any associated fees. Use a refinance auto loan calculator to model each offer precisely and quantify the total savings compared to staying with your current loan.

Successfully navigating the application and evaluation phase of the refinancing process is crucial for securing the most advantageous car auto loan terms through Auto Loan Refinancing.

The Role of the Refinance Calculator: Quantifying the Benefits of Auto Loan Refinancing

A refinance auto loan calculator is an indispensable tool throughout the refinancing process, particularly during the evaluation phase. It moves beyond simple estimation to provide concrete comparisons of the financial impact of Auto Loan Refinancing.

While a standard auto loan calculator helps you calculate payments for a new purchase loan, a refinance auto loan calculator is specifically designed to compare your existing loan’s remaining cost with a potential new refinance loan. It typically requires you to input details of your current loan (remaining balance, interest rate, remaining term) and the proposed terms of the new loan (new interest rate, new loan term).

The primary function of a refinance auto loan calculator is to clearly demonstrate the potential benefits of auto loan refinance. It quantifies how much you could save on total interest by switching to a lower interest rate. It shows how adjusting the loan term impacts your new monthly payment and the overall total loan cost. By inputting different scenarios from offers you receive, you can see side-by-side comparisons of:

- Your current monthly payment vs. your new estimated monthly payment.

- The total interest you would still pay on your current loan vs. the total interest on the new loan.

- The total savings in interest over the remaining life of the loan.

- The auto loan amortization schedule for the new loan.

Using a refinance auto loan calculator is the most effective way to make an informed decision during the refinancing process. It provides the clear financial data needed to confirm whether Auto Loan Refinancing is truly beneficial for your specific situation and which lender is offering the best terms.

Making the Most of Auto Loan Refinancing: Timing, Factors, and Long-Term Strategy

Successfully navigating Auto Loan Refinancing isn’t just about completing the steps; it’s also about strategically choosing the right time to act, understanding the factors that influence your outcome, and integrating it into your broader financial plan. Knowing when to consider auto loan refinancing is as important as knowing how to do it.

Key Indicators: When to Consider Auto Loan Refinancing

Deciding when to consider auto loan refinancing involves evaluating both your personal financial situation and the external market conditions. Several key indicators suggest it might be an opportune time:

- Your Credit Score Has Improved Significantly: If your credit score is noticeably higher than when you financed the car, you are much more likely to qualify for lower car loan rates. This is often the most impactful reason when to consider auto loan refinancing.

- Market Car Loan Rates Have Decreased: Keep an eye on current interest rates for car auto loans. If the average rates for borrowers with your credit score have dropped since you got your original loan, refinancing could lead to a lower interest rate.

- You Can Afford a Shorter Loan Term: If your income has increased or expenses have decreased, you might now be able to handle a higher monthly payment. Refinancing to a shorter loan term than your remaining term will increase your monthly payment but significantly reduce the total interest paid and shorten the time until you are debt-free. This is a great reason when to consider auto loan refinancing.

- You Need a Lower Monthly Payment: If unforeseen circumstances have tightened your budget, refinancing to a longer loan term might provide necessary short-term relief by reducing your monthly payment, even if it means paying more total interest over time.

- You Have an Older, High-Interest Loan: If you initially had a low credit score and accepted a very high interest rate, refinancing might be beneficial even if rates haven’t dropped significantly overall, simply because your credit score may have improved, allowing you to qualify for better market rates than you previously could access.

- Your Car Hasn’t Depreciated Excessively: Refinancing is typically easier if the amount you owe is less than or close to the car’s value (favorable LTV).

Evaluating these factors using a refinance auto loan calculator helps you determine when to consider auto loan refinancing and quantify the potential benefits.

Factors Influencing Your Eligibility and New Car Loan Rates

As mentioned in the process section, several factors critically influence whether you are approved for Auto Loan Refinancing and the terms you receive. Understanding these is key to preparing for the refinancing process.

- Creditworthiness: Your credit score and history are paramount. Lenders want to see a history of responsible credit use. A higher credit score means better car loan rates.

- Loan-to-Value (LTV) Ratio: How much you owe versus the car’s current market value. An LTV of 80% or less is ideal. Being “upside down” (LTV over 100%) makes refinancing challenging, though some lenders may still offer it, potentially at higher rates or requiring cash down.

- Vehicle Qualifications: The age, mileage, and condition of your vehicle matter. Most lenders have limits (e.g., car no older than 8-10 years, mileage limit). Newer, lower-mileage cars qualify more easily for better car loan rates.

- Income and Employment Stability: Lenders need assurance you can repay the loan. Stable income and employment are key.

- Payment History on Current Loan: A clean record of on-time payments on your existing auto loan is a strong positive factor during the refinancing process.

Focusing on improving these factors, particularly your credit score and potentially reducing your LTV, before applying can significantly enhance the outcome of your Auto Loan Refinancing efforts.

Potential Drawbacks and Final Considerations for Auto Loan Refinancing Success

While Auto Loan Refinancing offers many advantages, it’s important to approach it with a full understanding of potential drawbacks and final considerations.

- Fees Involved: Some lenders may charge origination fees, application fees, or other costs for processing the new loan. These fees can reduce the overall savings. Always factor all costs into your calculations using a refinance auto loan calculator when comparing offers.

- Extending the Loan Term: While it lowers the monthly payment, extending the loan term increases the total interest paid over the life of the loan. Use your refinance auto loan calculator to clearly see the difference in total loan cost between a shorter vs. longer term and ensure it aligns with your financial goals. Don’t sacrifice significant long-term savings for a minor reduction in the lower monthly payment if you don’t absolutely need it.

- No Guaranteed Approval: Even with a good credit score, approval is not guaranteed. Eligibility factors related to the vehicle (age, mileage, LTV) can still be barriers.

- Temporary Credit Score Dip: Applying for a new loan involves a hard credit pull, which can slightly and temporarily lower your credit score. This is usually minor, but avoid refinancing if you plan to apply for other significant credit soon (like a mortgage).

- Loss of Original Loan Perks: Very rarely, an original loan might have unique benefits (like a low rate tied to specific incentives) that you lose by refinancing. Check your original loan terms.

To maximize the benefits of Auto Loan Refinancing, diligently shop around, compare offers using a refinance auto loan calculator, read the new loan contract carefully, and ensure the new terms truly represent an improvement over your current situation after considering all fees and the impact of the loan term change on total interest. Successful Auto Loan Refinancing is a strategic financial decision made with careful planning and evaluation.

In conclusion, Auto Loan Refinancing is a powerful financial strategy enabling vehicle owners to replace their existing car loan with a new one, primarily aiming to secure a lower interest rate, thereby reducing the total interest paid, or to adjust the loan term for a different monthly payment. The benefits of auto loan refinance, including potential savings and increased budgetary flexibility, make it a compelling option for many. Navigating the refinancing process involves checking your credit score, shopping for car loan rates, applying to lenders, and critically, using a refinance auto loan calculator to quantify potential savings and compare offers based on new monthly payment, total interest, and total loan cost. Knowing when to consider auto loan refinancing—such as after a credit score improvement or when market car loan rates drop—is key. While potential drawbacks exist, careful evaluation ensures Auto Loan Refinancing is a successful move towards more advantageous terms for your car auto loan.