Facing overwhelming debt can be one of the most stressful and challenging experiences an individual or business can encounter. Whether due to job loss, medical emergencies, business failure, or simply accumulating too much unsecured debt, the burden of creditors’ calls, mounting interest, and potential legal action can feel insurmountable. In many legal systems around the world, and notably under the Bankruptcy Code in the United States, a structured legal framework exists to provide a pathway out of this distress: Bankruptcy Law. Bankruptcy Law is a complex area of federal law designed to help individuals and businesses who can no longer pay their outstanding debts. Its primary purposes are twofold: to provide debtors with a financial fresh start by discharging certain debts, and to provide a fair and orderly process for liquidating assets (if any) or proposing a repayment plan to creditors, ensuring equitable distribution. Far from being a mark of failure, Bankruptcy Law is often a lifeline, offering crucial debt relief and a legal mechanism to reorganize finances or eliminate unsustainable obligations. Understanding Bankruptcy Law, its core principles, the different types of bankruptcy available, and the overall bankruptcy process is essential for anyone grappling with severe financial difficulties and considering this legal avenue for resolution. This comprehensive guide will delve into the fundamental concepts of Bankruptcy Law, explain its purpose and why it exists, detail the key chapters outlining the different pathways to bankruptcy relief, and discuss the bankruptcy process, potential bankruptcy consequences, and the vital role of legal professionals like a bankruptcy lawyer or bankruptcy attorney in navigating this complex system.

Toc

Understanding Bankruptcy Law: Providing Debt Relief and a Financial Fresh Start

At its core, Bankruptcy Law is a legal mechanism for dealing with insolvency – the inability of an individual or organization to pay its debts when they are due. It operates under a specific set of rules and procedures outlined in the applicable Bankruptcy Code, designed to balance the needs of debtors seeking relief with the rights of creditors seeking repayment. Understanding the fundamental principles of Bankruptcy Law is the first step in appreciating its role in a modern economy.

What is Bankruptcy Law? Defining the Legal Framework for Insolvency

Bankruptcy Law is a body of federal law that governs the process by which individuals and businesses can resolve their debts when they are unable to pay them. In the United States, this law is primarily found in Title 11 of the United States Code, commonly referred to as the Bankruptcy Code. The code establishes the rules and procedures for filing for bankruptcy, defines the different types of bankruptcy cases, outlines which debts can be eliminated (discharge of debt), determines how assets are treated, and sets the framework for dealing with creditors.

When an individual or business filing for bankruptcy, they petition a federal bankruptcy court for relief. The court then oversees the process according to the rules set forth in Bankruptcy Law. The specific path taken depends on the debtor’s circumstances and the type of bankruptcy case filed (e.g., Chapter 7, 11, or 13). The law provides different mechanisms for resolving debt, ranging from liquidating assets to pay creditors to establishing court-supervised repayment plans or reorganizing a business’s financial structure. Importantly, Bankruptcy Law provides a legal shield against creditors through the “automatic stay” (discussed later), halting most collection efforts once a case is filed. This legal framework is complex, and navigating its intricacies typically requires the assistance of a professional familiar with Bankruptcy Law, such as a bankruptcy lawyer or bankruptcy attorney. It is a structured system designed to address financial distress in a predictable and legally defined manner.

The Dual Purpose: Balancing Debtor Relief and Creditor Rights

One of the defining characteristics of Bankruptcy Law is its dual purpose: to provide a financial fresh start for honest debtors while ensuring a fair and orderly process for creditors to potentially recover some portion of the debt owed to them. This balance is fundamental to the philosophy behind the Bankruptcy Code.

For the debtor, Bankruptcy Law offers the significant benefit of debt relief, potentially leading to the discharge of debt. This means that certain qualifying debts are legally eliminated, and the debtor is no longer obligated to repay them. This provides a crucial opportunity for individuals overwhelmed by debt to clear their financial slate and begin rebuilding their financial lives – the essence of a financial fresh start. For businesses, bankruptcy can offer a chance to reorganize and continue operating, shedding unsustainable debt burdens and potentially saving jobs and economic activity. The “automatic stay” is a key protective feature for debtors, immediately stopping most lawsuits, foreclosures, repossessions, and wage garnishments upon filing for bankruptcy.

For creditors, while bankruptcy may mean they do not recover the full amount owed, Bankruptcy Law provides a structured alternative to a chaotic “race to the courthouse.” Without bankruptcy, creditors would individually pursue debtors through various legal means, potentially leading to unfair outcomes where aggressive creditors recover more than others, and the debtor’s assets are liquidated haphazardly. Bankruptcy Law establishes a centralized court process where all creditors are notified, claims are verified, and any available assets are distributed according to a legally defined priority system. In reorganization cases, the law provides a framework for negotiating repayment plans that, while not always paying 100%, offer a structured path for partial recovery based on the debtor’s ability to pay or the reorganized entity’s future viability. This dual focus is integral to Bankruptcy Law, aiming for a more equitable outcome for all parties involved in cases of insolvency.

Why Bankruptcy Law Exists: Addressing Overwhelming Debt and Economic Distress

The existence of Bankruptcy Law in modern legal systems is driven by both humanitarian and economic considerations. It recognizes that individuals and businesses can, despite their best efforts, fall into overwhelming debt due to circumstances beyond their control or through missteps.

On a personal level, allowing individuals access to debt relief and a financial fresh start prevents situations of perpetual indebtedness that can destroy lives, families, and societal well-being. Without the possibility of discharge of debt through Bankruptcy Law, individuals might remain trapped under insurmountable financial burdens indefinitely, unable to contribute productively to the economy or rebuild their lives. Providing a fresh start offers them a chance to recover, find stable housing and employment, and re-engage as productive members of society. This humanitarian aspect is a core principle underpinning the ability to get debt relief through Bankruptcy Law.

Economically, Bankruptcy Law provides a necessary mechanism for dealing with failed businesses and individuals in financial distress in a way that minimizes disruption and facilitates economic recovery. For businesses, Chapter 11 bankruptcy allows for reorganization, potentially saving viable businesses, preserving jobs, and ensuring continued economic activity. For individuals, clearing unsustainable debt allows them to re-enter the consumer market, purchase goods and services, and contribute to economic demand, rather than being paralyzed by unmanageable obligations. The orderly process for creditors under the Bankruptcy Code also provides a degree of predictability and fairness, which is important for the functioning of credit markets. It allows for the efficient winding down of non-viable entities (Chapter 7 liquidation), releasing assets back into the economy. Bankruptcy Law is therefore a vital component of a healthy economy, providing necessary safety valves and mechanisms for dealing with financial failure in a structured, legally governed manner, ultimately facilitating recovery and continued economic activity for both individuals and the broader market.

1. https://tamtho.com.vn/mmoga-exploring-aws-cloud-computing-the-worlds-leading-cloud-platform/

3. https://tamtho.com.vn/mmoga-defining-what-is-chapter-11-bankruptcies-the-path-to-reorganization/

4. https://tamtho.com.vn/mmoga-facing-overwhelming-debt-why-you-need-a-lawyer-for-bankruptcies/

5. https://tamtho.com.vn/mmoga-understanding-the-landscape-what-are-the-3-types-of-bankruptcies/

Key Types of Bankruptcy Under the Bankruptcy Code

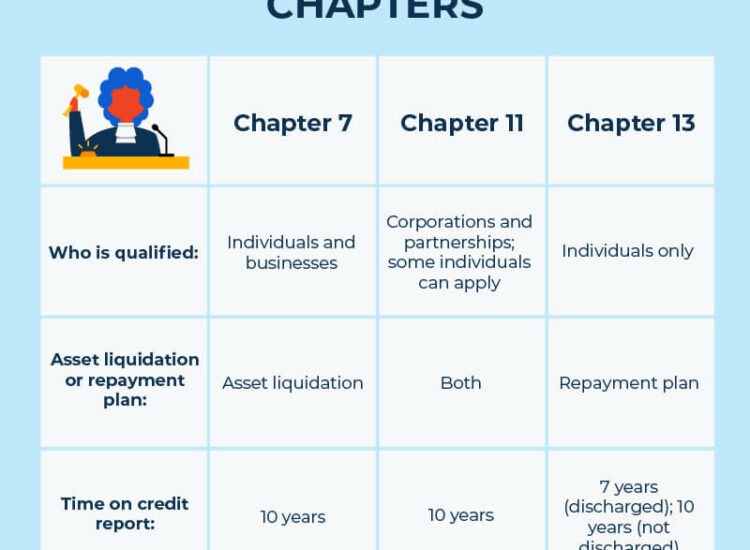

The Bankruptcy Code outlines different chapters that represent distinct types of bankruptcy cases, each designed for specific circumstances and goals. The most common chapters for individuals are Chapter 7 and Chapter 13, while Chapter 11 is primarily used for business reorganization. Understanding the differences between these types of bankruptcy is crucial for a debtor determining the most appropriate path for debt relief.

Chapter 7 Bankruptcy: Liquidation for a Quick Financial Fresh Start

Chapter 7 bankruptcy, often referred to as liquidation bankruptcy, is the most common type of bankruptcy filing for individuals seeking a relatively quick financial fresh start by discharging most unsecured debts. In a Chapter 7 case, a court-appointed trustee is assigned to the case to oversee the process.

The primary goal of Chapter 7 bankruptcy is the discharge of debt. Debts that are typically dischargeable in Chapter 7 include credit card debt, medical bills, personal loans, and other unsecured debts. Certain debts, such as most taxes, child support, alimony, and student loans (except in rare cases of undue hardship), are generally not dischargeable in Chapter 7.

In a Chapter 7 case, the trustee reviews the debtor’s assets. The debtor is allowed to keep certain assets that are considered “exempt” under federal or state Bankruptcy Law (exemptions vary by jurisdiction). Non-exempt assets, if any, are gathered and potentially sold by the trustee, with the proceeds distributed among the creditors according to priority rules set by the Bankruptcy Code. Most Chapter 7 cases involving individuals with limited assets are “no-asset” cases, meaning there are no non-exempt assets for the trustee to sell, and creditors receive nothing from the liquidation process.

Eligibility for Chapter 7 bankruptcy is determined by a “means test.” This test evaluates the debtor’s income, household size, and expenses to determine if their income is low enough to qualify for Chapter 7. If their income is too high, they may be required to file under Chapter 13 instead. The bankruptcy process for Chapter 7 is often completed within a few months (typically 4-6 months) from the date of filing for bankruptcy, ending with the discharge of debt, offering a relatively rapid financial fresh start.

Chapter 13 bankruptcy, also known as wage earner’s bankruptcy or reorganization bankruptcy for individuals, is designed for individuals with regular income who can afford to repay some or all of their debts over time through a court-approved repayment plan. Unlike Chapter 7, Chapter 13 does not involve liquidating assets.

The primary goal of Chapter 13 bankruptcy is to propose and successfully complete a repayment plan to creditors over a period of three to five years. The plan details how the debtor will make payments to the trustee, who then distributes the funds to creditors based on the terms of the plan and the priorities established by the Bankruptcy Code. The amount paid through the plan is based on the debtor’s disposable income (income remaining after reasonable and necessary living expenses) and the value of the debtor’s non-exempt assets.

Chapter 13 bankruptcy is often used by individuals who have non-exempt assets they wish to keep (such as a house with significant equity that is not fully exempt) or who have too much income to qualify for Chapter 7 under the means test. It can also be used to catch up on missed mortgage payments or car payments, prevent foreclosure or repossession, and manage priority debts like certain taxes or child support arrears. Once the repayment plan is successfully completed (usually after 3 to 5 years), any remaining dischargeable debts are eliminated through the discharge of debt, providing a financial fresh start after fulfilling the terms of the plan. The bankruptcy process for Chapter 13 is longer and involves ongoing compliance with the repayment plan.

Chapter 11 Bankruptcy: Reorganization for Businesses (and Some Individuals)

Chapter 11 bankruptcy is primarily designed for businesses that wish to reorganize their debts and continue operating, rather than liquidating. It is a more complex and often more expensive process than Chapter 7 or 13, but it allows the business to restructure its finances, renegotiate terms with creditors, and potentially emerge from bankruptcy as a viable entity. While typically used by corporations, partnerships, or limited liability companies, certain individuals with very complex financial affairs or debts exceeding the limits for Chapter 13 can also file under Chapter 11.

The main goal of Chapter 11 bankruptcy is reorganization. The business (referred to as the “debtor in possession” unless a trustee is appointed) typically continues to operate its business affairs under the court’s supervision. The debtor proposes a plan of reorganization that details how it will restructure its debts, operate going forward, and make payments to creditors over time. Creditors have a say in the process and vote on the proposed plan. If the plan is approved by the court (confirmed), the business proceeds according to the plan’s terms, eventually receiving a discharge of debt for qualifying restructured debts upon successful completion of the plan’s requirements.

Chapter 11 bankruptcy is used to address complex debt structures, renegotiate contracts and leases, sell off non-essential parts of the business, and obtain new financing to support reorganization efforts. It is a powerful tool for businesses facing financial distress but possessing a viable core operation that can be salvaged through restructuring. The bankruptcy process in Chapter 11 is highly involved, can take a year or more, and requires extensive legal and financial expertise, often necessitating a dedicated bankruptcy lawyer or team familiar with complex corporate reorganizations under the Bankruptcy Code.

Regardless of the chapter filed, the bankruptcy process follows a general timeline involving specific steps and legal requirements. Understanding this process, along with the potential outcomes and the importance of professional guidance, is crucial for anyone considering filing for bankruptcy. While offering significant debt relief and a financial fresh start, bankruptcy also carries potential bankruptcy consequences.

The Bankruptcy Process: Step-by-Step from Filing to Discharge of Debt

The bankruptcy process begins with the debtor filing for bankruptcy by submitting a petition and required schedules and statements with the federal bankruptcy court in the appropriate jurisdiction. This initial filing is a critical step and must be accurate and complete.

1. https://tamtho.com.vn/mmoga-exploring-aws-cloud-computing-the-worlds-leading-cloud-platform/

2. https://tamtho.com.vn/mmoga-facing-overwhelming-debt-why-you-need-a-lawyer-for-bankruptcies/

4. https://tamtho.com.vn/mmoga-understanding-the-landscape-what-are-the-3-types-of-bankruptcies/

Upon filing, the automatic stay goes into effect immediately. The automatic stay is a powerful legal injunction that automatically stops most collection actions against the debtor. This includes lawsuits, foreclosures, repossessions, wage garnishments, and creditor calls. It provides the debtor with immediate relief from collection pressures and breathing room to proceed with the rest of the bankruptcy process.

Within a few weeks after filing, the debtor must attend a meeting of creditors, also known as the Section 341 meeting. This meeting is typically brief and is presided over by the trustee (in Chapter 7 and 13) or a representative of the U.S. Trustee (in Chapter 11). Creditors are invited to attend and ask questions under oath about the debtor’s financial situation, but they rarely appear in most consumer cases. The debtor is required to attend and answer questions from the trustee.

Following the meeting of creditors, the bankruptcy process diverges depending on the chapter:

- In Chapter 7 bankruptcy, the trustee administers any non-exempt assets (if any). Assuming the debtor completes the required financial management course, the court typically grants the discharge of debt a few months after the meeting of creditors.

- In Chapter 13 bankruptcy, the debtor’s proposed repayment plan is reviewed and must be confirmed by the court. The debtor begins making payments to the trustee, who distributes them according to the confirmed plan over 3 to 5 years. The discharge of debt is granted only after the plan is successfully completed.

- In Chapter 11 bankruptcy, the debtor works to develop a plan of reorganization, which must be approved by creditors and confirmed by the court. The bankruptcy process involves negotiations with different classes of creditors. The discharge of debt (for qualifying debts) typically occurs upon plan confirmation or substantial consummation of the plan.

Throughout the bankruptcy process, debtors must comply with various requirements, including attending mandatory credit counseling before filing and financial management courses before discharge of debt.

Potential Bankruptcy Consequences and Bankruptcy Benefits

Deciding to file for bankruptcy involves carefully weighing the potential bankruptcy consequences against the significant bankruptcy benefits of debt relief and a financial fresh start.

The most significant bankruptcy benefits include:

- Discharge of Debt: The primary benefit is the legal elimination of qualifying debts, providing a financial fresh start and freeing the debtor from the obligation to repay them.

- Automatic Stay: Immediate protection from most creditor collection efforts, halting lawsuits, foreclosures, repossessions, and wage garnishments.

- Structured Repayment or Liquidation: Provides an orderly, court-supervised process for resolving outstanding debts, either through a manageable payment plan (Chapter 13, 11) or equitable asset distribution (Chapter 7).

- End to Creditor Harassment: Creditors are legally prohibited from contacting the debtor regarding discharged debts.

However, filing for bankruptcy also comes with potential bankruptcy consequences:

- Impact on Credit Score: Bankruptcy has a significant negative impact on the debtor’s credit score and can remain on their credit report for up to 7-10 years. This can make it harder to obtain future credit, loans, or even rent an apartment.

- Loss of Assets (in Chapter 7): In Chapter 7, non-exempt assets can be liquidated by the trustee, although many filers are able to protect most, if not all, of their assets through exemptions.

- Public Record: Bankruptcy filings are public record, meaning they can be viewed by anyone who searches court records.

- Difficulty Discharging Certain Debts: Not all debts are dischargeable (e.g., most taxes, student loans, child support).

- Restrictions on Future Bankruptcy Filings: There are limitations on how often an individual can receive a discharge of debt through bankruptcy.

Understanding both the advantages and disadvantages is vital when considering filing for bankruptcy. The severity of the bankruptcy consequences often depends on the debtor’s specific financial situation and the type of bankruptcy filed, and for many, the bankruptcy benefits of a financial fresh start outweigh the negative impacts given their current overwhelming debt burden.

The Indispensable Role of a Bankruptcy Lawyer or Bankruptcy Attorney

Given the complexity of Bankruptcy Law and the significant potential bankruptcy consequences and bankruptcy benefits involved, the role of a qualified legal professional is indispensable. A bankruptcy lawyer or bankruptcy attorney provides crucial guidance throughout the entire bankruptcy process.

A skilled bankruptcy attorney can:

- Evaluate your specific financial situation and advise you on whether bankruptcy is the right option for you.

- Explain the different types of bankruptcy (Chapter 7, 11, 13) and help you determine which chapter is most appropriate for your goals and circumstances, including determining eligibility for Chapter 7 via the “means test.”

- Ensure that all required documents for filing for bankruptcy are completed accurately and completely. Errors or omissions can cause significant delays or even lead to the dismissal of the case.

- Advise you on which assets are likely to be exempt and which might be at risk of liquidation in Chapter 7.

- Guide you through the bankruptcy process, including preparing you for the meeting of creditors.

- Handle communications and negotiations with creditors and the trustee on your behalf.

- Address any potential challenges or objections raised by creditors or the trustee.

- Ensure you fulfill all requirements necessary to receive a discharge of debt.

- In Chapter 13 or 11 cases, assist in developing, proposing, and confirming a viable repayment or reorganization plan.

Attempting to navigate Bankruptcy Law and the bankruptcy process without a bankruptcy lawyer is highly risky. The nuances of the Bankruptcy Code, exemption laws, and court procedures require specialized knowledge. Mistakes can lead to delays, denial of discharge of debt, or even accusations of bankruptcy fraud. Therefore, for anyone considering filing for bankruptcy as a path to debt relief and a financial fresh start, consulting with an experienced bankruptcy attorney is strongly recommended to ensure the process is handled correctly and to maximize the potential bankruptcy benefits while minimizing negative bankruptcy consequences.

In conclusion, Bankruptcy Law, governed by the Bankruptcy Code, provides a legal framework for individuals and businesses to address overwhelming debt. Its core purposes are to offer debt relief and a financial fresh start to debtors while ensuring an orderly process for creditors. The key types of bankruptcy—Chapter 7 bankruptcy (liquidation), Chapter 13 bankruptcy (wage earner’s plan), and Chapter 11 bankruptcy (reorganization)—offer different pathways depending on the debtor’s circumstances. Navigating the bankruptcy process, from filing for bankruptcy and the automatic stay to the meeting of creditors and the eventual discharge of debt, requires careful adherence to legal procedures. While significant bankruptcy benefits, such as debt relief and a financial fresh start, are available, potential bankruptcy consequences like impact on credit score must be considered. Given the complexity, the guidance of a qualified bankruptcy lawyer or bankruptcy attorney is crucial to successfully utilize Bankruptcy Law as a tool for financial recovery.