Facing overwhelming debt can feel like an impossible situation, a complex tangle of financial obligations with no clear path to resolution. For individuals and businesses in the United States who find themselves unable to pay their creditors, the federal legal system offers a structured pathway for addressing insolvency under Bankruptcy Law. This legal framework, primarily governed by the Bankruptcy Code, provides debtors with potential debt relief and an opportunity for a financial fresh start. However, bankruptcy is not a one-size-fits-all solution. The Bankruptcy Code outlines different chapters, each designed to address specific financial situations and goals. While numerous chapters exist within the Bankruptcy Code, three stand out as the most commonly utilized and discussed types of bankruptcy for individuals and businesses facing financial distress. Understanding these 3 Types of Bankruptcies – Chapter 7, Chapter 13, and Chapter 11 – is the crucial first step for anyone considering filing for bankruptcy as a means of overcoming insurmountable debt. Each type offers a distinct approach to resolving debt, with different eligibility requirements, processes, and potential outcomes. This comprehensive guide will explore the landscape of Bankruptcy Law by defining these core types of bankruptcy, explaining their purpose, detailing their individual characteristics, and comparing how the bankruptcy process unfolds for each, ultimately helping you understand the fundamental differences among the 3 Types of Bankruptcies and why they exist to serve distinct needs in providing debt relief and a financial fresh start.

Toc

Understanding the Landscape: What are the 3 Types of Bankruptcies?

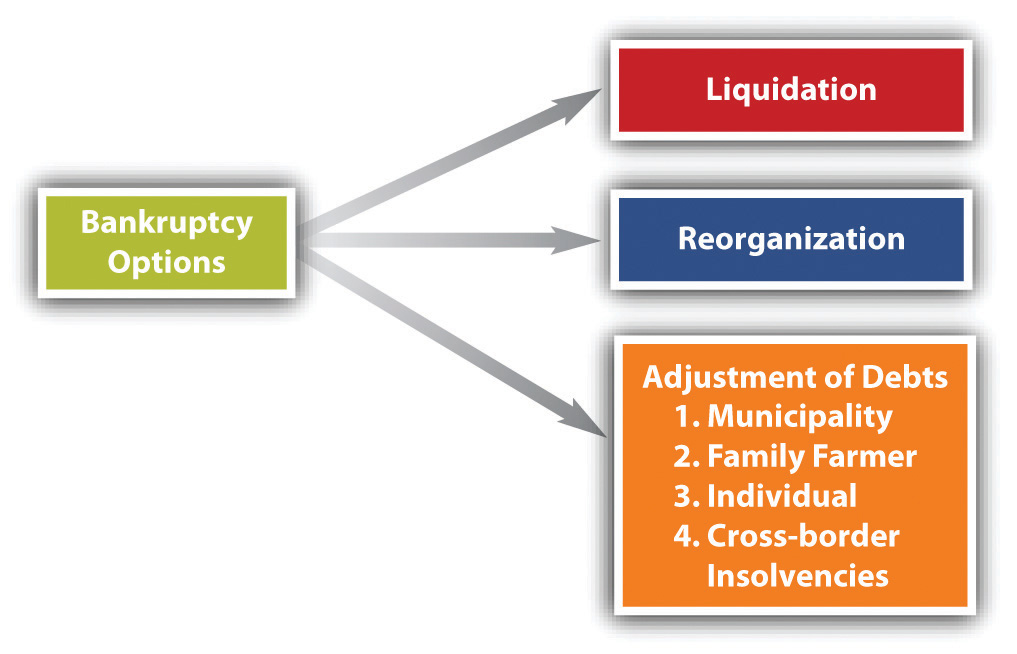

The Bankruptcy Code provides a systematic approach to dealing with financial insolvency, recognizing that debtors’ circumstances vary widely. This led to the creation of different legal pathways, or chapters, each offering a unique method for resolving debt. Identifying and understanding these core options is central to answering the question: What are the 3 Types of Bankruptcies that most people encounter?

The Foundation of Bankruptcy Law: Providing Debt Relief and a Financial Fresh Start

Before delving into the specific types of bankruptcy, it’s essential to grasp the overarching purpose of Bankruptcy Law itself. Rooted in the U.S. Constitution, Bankruptcy Law serves a dual fundamental purpose: providing a financial fresh start for debtors and ensuring a fair and orderly process for creditors to recover as much as possible under the circumstances. For individuals, Bankruptcy Law offers a legal mechanism to discharge certain debts, allowing them to rebuild their financial lives without the burden of overwhelming obligations. This debt relief is a core principle, recognizing that people can fall into debt due to unforeseen events and deserve a chance to recover. For businesses, Bankruptcy Law can provide an opportunity to reorganize and continue operating, preserving jobs and economic activity, or to liquidate assets in an orderly fashion, ensuring equitable distribution among creditors.

The Bankruptcy Code provides the legal framework and rules for achieving these goals. It dictates who is eligible to file for bankruptcy, what types of bankruptcy cases are available, which debts can be eliminated, how assets are treated, and the procedures that must be followed in bankruptcy court. The system is designed to replace a potentially chaotic scenario where individual creditors aggressively pursue debtors, with a centralized, court-supervised process that treats all parties fairly according to established legal priorities. This foundation of Bankruptcy Law, aiming for both debtor rehabilitation and orderly creditor treatment, sets the stage for understanding the distinct roles played by the different types of bankruptcy cases available under the Bankruptcy Code.

Introducing the Main Types of Bankruptcy: Chapter 7, Chapter 13, and Chapter 11

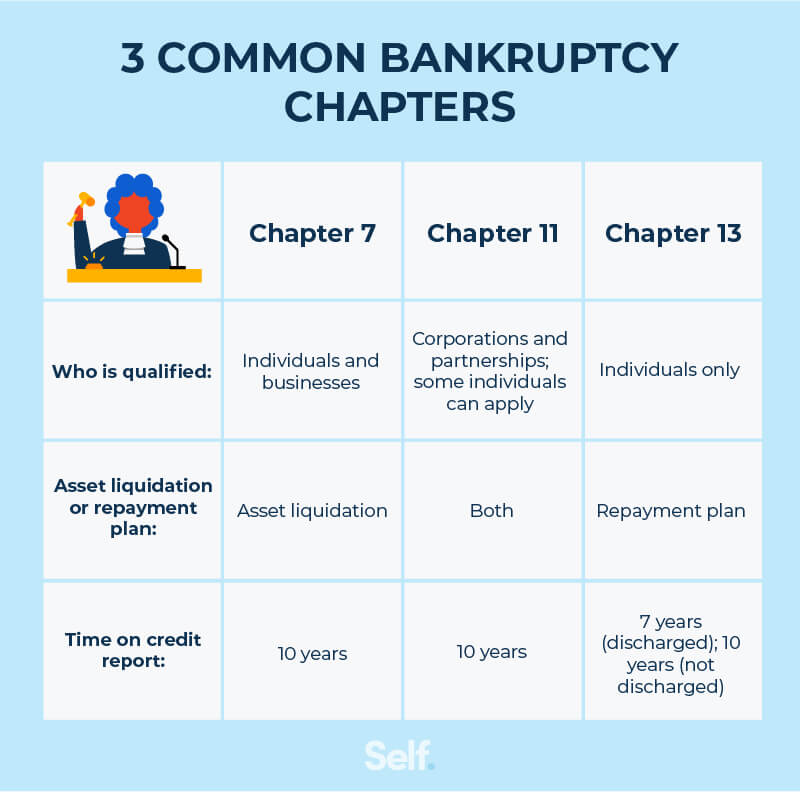

When people refer to the most common types of bankruptcy, they are typically referring to Chapters 7, 13, and 11 of the U.S. Bankruptcy Code. These three chapters represent the primary legal pathways used by individuals and businesses facing different levels of insolvency and having different goals for resolving their debt. Understanding the basic premise of each is key to differentiating among the 3 Types of Bankruptcies.

- Chapter 7 Bankruptcy: This is often called liquidation bankruptcy. It is typically used by individuals (and sometimes businesses, though less commonly) who have limited income and assets that are largely protected by exemption laws. The primary goal is to quickly obtain a discharge of debt for most unsecured debts by potentially liquidating any non-exempt assets.

- Chapter 13 Bankruptcy: This is known as wage earner’s bankruptcy or reorganization for individuals. It is designed for individuals with regular income who can afford to repay some or all of their debts over time through a court-approved repayment plan. The debtor keeps their assets and makes payments to a trustee for three to five years.

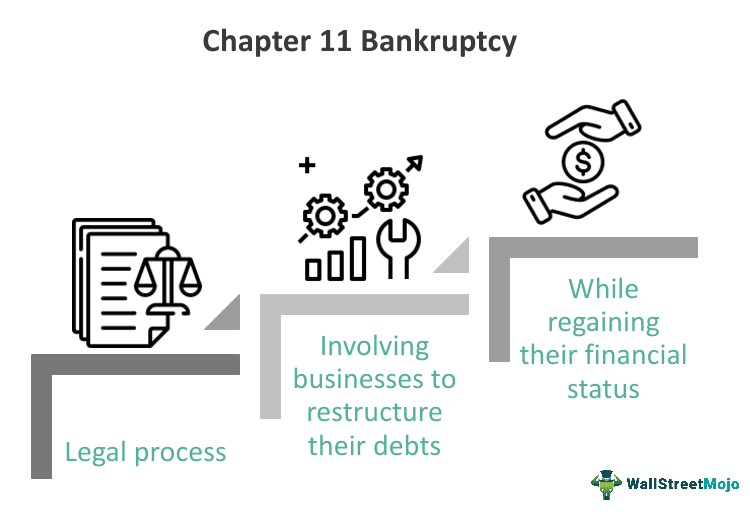

- Chapter 11 Bankruptcy: This is primarily used for business reorganization (though some individuals with very complex finances or high debt amounts exceeding Chapter 13 limits may file). It allows the debtor to restructure its debts and operations while continuing to operate the business, proposing a plan of reorganization that must be confirmed by the bankruptcy court.

These three represent the most prevalent types of bankruptcy cases filed in the U.S. system. While other chapters exist (like Chapter 12 for family farmers/fishermen or Chapter 15 for international cases), Chapters 7, 13, and 11 are the core 3 Types of Bankruptcies that individuals and businesses most often consider when facing financial distress and seeking debt relief.

Why These Specific 3 Types of Bankruptcies Exist to Serve Different Needs

The reason the Bankruptcy Code provides these specific 3 Types of Bankruptcies is because individuals and businesses facing insolvency have vastly different circumstances, income levels, asset profiles, and goals for their financial future. A single approach would not adequately serve the diverse needs of debtors.

Chapter 7 bankruptcy exists to provide a relatively fast and direct path to debt relief for individuals who truly do not have the disposable income to make meaningful payments towards their debts over time and whose assets are primarily protected by exemptions. It offers a quick financial fresh start by eliminating most unsecured debts, allowing them to move forward unburdened.

Chapter 13 bankruptcy serves individuals with regular income who can afford to repay some of their debts. It is a crucial option for debtors who have valuable non-exempt assets they want to keep (like a home with significant equity) or who have fallen behind on secured debts (like a mortgage or car loan) and need a structured plan to catch up on missed payments and prevent foreclosure or repossession. Chapter 13 provides a pathway to manage debt and keep assets through a court-supervised repayment plan.

3. https://tamtho.com.vn/mmoga-facing-overwhelming-debt-why-you-need-a-lawyer-for-bankruptcies/

5. https://tamtho.com.vn/mmoga-defining-what-is-chapter-11-bankruptcies-the-path-to-reorganization/

Chapter 11 bankruptcy is tailored for complex situations, primarily for businesses that are struggling financially but are fundamentally viable and wish to continue operating. It provides the legal tools necessary to restructure debt, renegotiate contracts, and implement operational changes under court supervision, aiming to save the business, preserve jobs, and maximize value for creditors through ongoing operations rather than immediate sale of assets. While also available to individuals with very large and complex debts, its design principles are focused on the intricacies of business restructuring.

The existence of these distinct 3 Types of Bankruptcies allows Bankruptcy Law to provide more tailored and effective debt relief solutions, recognizing that the best path for a low-income individual with few assets differs greatly from that of a wage earner wanting to save their home, or a large corporation seeking to reorganize its billions in debt. Each type addresses a specific set of needs and circumstances within the broader goal of resolving insolvency under the Bankruptcy Code.

Delving Deeper into Each Type: Chapter 7, Chapter 13, and Chapter 11 Explained

To fully appreciate the differences among the 3 Types of Bankruptcies, it’s important to delve into the specifics of how each chapter operates, who qualifies, and what the typical outcome involves. While all provide debt relief, the mechanism and implications vary significantly.

Chapter 7 Bankruptcy: Liquidation for a Quick Discharge

Chapter 7 bankruptcy, as one of the most common types of bankruptcy for consumers, is designed for individuals with limited financial resources who need a swift financial fresh start. The defining characteristic is the potential for liquidation of non-exempt assets.

The Chapter 7 process begins with filing for bankruptcy by submitting a petition and detailed schedules to the bankruptcy court. An automatic stay immediately halts most creditor collection actions. A court-appointed trustee is assigned to the case. The debtor must attend a meeting of creditors, where the trustee reviews the filing and asks questions under oath. The trustee’s primary role is to identify any non-exempt assets, liquidate them, and distribute the proceeds to creditors. However, a key feature of Chapter 7 bankruptcy is the ability for debtors to protect certain essential assets through bankruptcy exemptions (either federal or state). In the vast majority of individual Chapter 7 bankruptcy cases, all of the debtor’s assets are covered by exemptions, resulting in a “no-asset” case where there is nothing for the trustee to sell.

Eligibility for Chapter 7 bankruptcy is determined by the means test, which assesses the debtor’s income against their state’s median income and calculates disposable income. If the debtor’s income is too high, they may be directed to Chapter 13 bankruptcy. The main bankruptcy benefits of Chapter 7 bankruptcy include a rapid discharge of debt (typically within 4-6 months of filing for most unsecured debts) and immediate protection from creditors via the automatic stay. However, a potential bankruptcy consequence is the risk of losing non-exempt assets (though this is rare for most filers). Chapter 7 bankruptcy is generally suitable for individuals struggling with significant unsecured debt (credit cards, medical bills) who have little or no non-exempt property and who meet the income requirements. It offers a direct path to get rid of debt and begin rebuilding financially.

Chapter 13 Bankruptcy: Repayment Plans for Individuals with Income

Chapter 13 bankruptcy, also a common option for individuals, differs fundamentally from Chapter 7 by focusing on a repayment plan rather than liquidation. It is designed for individuals with regular income who can afford to pay back some or all of their debts over time. Chapter 13 is often referred to as a “wage earner’s plan.”

The Chapter 13 process begins with filing for bankruptcy and proposing a repayment plan to the bankruptcy court and trustee. The automatic stay provides immediate protection from creditors. A Chapter 13 trustee is appointed to receive payments from the debtor and distribute them to creditors according to the confirmed plan. The repayment plan typically lasts for three to five years. The amount paid monthly is based on the debtor’s disposable income (income left after allowed living expenses) and the value of any non-exempt assets the debtor wishes to keep.

Chapter 13 bankruptcy offers several unique bankruptcy benefits. It allows debtors to keep non-exempt assets that they would lose in Chapter 7 (like a home with non-exempt equity) by including their value in the repayment plan. It can be used to catch up on missed payments for secured debts like mortgages or car loans to prevent foreclosure or repossession. It can also help manage certain debts that are not dischargeable in Chapter 7. Eligibility for Chapter 13 bankruptcy requires the debtor to have regular income and for their debts to be below certain limits set by the Bankruptcy Code. The discharge of debt in Chapter 13 is granted only after the successful completion of the court-approved repayment plan, which can take up to five years. While the process is longer than Chapter 7, it provides a structured way to manage debt, keep assets, and ultimately achieve a financial fresh start upon plan completion.

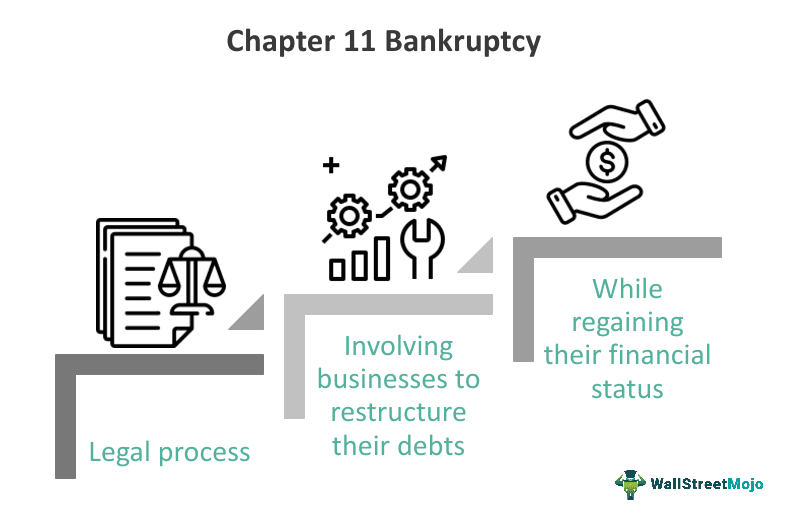

Chapter 11 Bankruptcy: Reorganization for Businesses and Complex Cases

Chapter 11 bankruptcy is distinct from Chapters 7 and 13 and is primarily used by businesses seeking to reorganize their debts and continue operating. It is a more complex and expensive process designed for debtors with significant assets and complex financial structures that require comprehensive restructuring.

The Chapter 11 process begins with filing for bankruptcy and the implementation of the automatic stay. In most Chapter 11 bankruptcy cases, the debtor continues to operate the business as a “debtor in possession” under the supervision of the bankruptcy court. The debtor in possession works to develop a Chapter 11 Plan of Reorganization, which outlines how the business will restructure its debts, operations, and finances going forward and how creditors will be treated. This process involves extensive negotiation with different classes of creditors, who vote on the proposed plan.

1. https://tamtho.com.vn/mmoga-exploring-aws-cloud-computing-the-worlds-leading-cloud-platform/

2. https://tamtho.com.vn/mmoga-defining-what-is-chapter-11-bankruptcies-the-path-to-reorganization/

5. https://tamtho.com.vn/mmoga-facing-overwhelming-debt-why-you-need-a-lawyer-for-bankruptcies/

The main bankruptcy benefits of Chapter 11 bankruptcy for businesses include the ability to continue operations, shed unsustainable debts (discharge of debt for qualifying restructured debts upon confirmation/completion), renegotiate contracts and leases, and implement operational changes to become profitable again. Chapter 11 is also used by individuals with very large and complex debts that exceed Chapter 13 limits. The Chapter 11 process is lengthy, often taking a year or more, and requires significant legal and financial expertise. Successfully confirming and implementing a Chapter 11 Plan of Reorganization leads to the debtor’s emergence from bankruptcy with a restructured balance sheet and a pathway to a viable future, representing a financial fresh start for the entity or individual involved. It is a powerful tool for reorganization bankruptcy.

Choosing the Right Path: Eligibility, Process, and Outcomes of These 3 Types of Bankruptcies

Deciding which of the 3 Types of Bankruptcies is appropriate for your situation requires careful consideration of your financial circumstances, goals, and eligibility. Each type has distinct requirements, a unique process, and different outcomes regarding debt relief and asset treatment.

Eligibility Criteria: Who Qualifies for Each of the 3 Types of Bankruptcies?

Eligibility is a key factor in determining which of the 3 Types of Bankruptcies you can file under the Bankruptcy Code.

- Chapter 7 Eligibility: Primarily for individuals. Determined by the means test, which assesses if income is low enough to qualify for liquidation. Debt limits are not the primary factor, but the debtor must primarily have unsecured debt. Businesses can file, but it typically leads to winding down operations.

- Chapter 13 Eligibility: For individuals with regular income. Eligibility depends on having income sufficient to fund a repayment plan and having secured and unsecured debts below certain limits set by the Bankruptcy Code (these limits are adjusted periodically). It is not available to corporations or partnerships.

- Chapter 11 Eligibility: Available to individuals and businesses. There are generally no debt limits for Chapter 11 bankruptcy, making it suitable for debtors whose debts exceed Chapter 13 limits. It is used when a debtor needs to reorganize and continue operating, which is not the primary goal of Chapter 7.

Assessing eligibility is a critical first step in the bankruptcy process and often requires the guidance of a legal professional familiar with Bankruptcy Law to correctly apply the rules, such as the means test for Chapter 7 bankruptcy.

The Bankruptcy Process for Each Type: From Filing to Discharge or Confirmation

The bankruptcy process differs significantly for each of the 3 Types of Bankruptcies after the initial filing and the implementation of the automatic stay.

- Chapter 7 Process: Relatively fast. Filing -> Automatic Stay -> Meeting of Creditors (approx. 1 month post-filing) -> Trustee reviews assets/claims -> Financial Management Course -> Discharge of Debt (approx. 4-6 months post-filing for most debts). Involves potential asset liquidation.

- Chapter 13 Process: Longer duration. Filing -> Automatic Stay -> Propose Repayment Plan -> Meeting of Creditors (approx. 1 month post-filing) -> Plan Confirmation Hearing -> Make Payments to Trustee for 3-5 years -> Financial Management Course -> Discharge of Debt (after completing plan payments). Debtor keeps assets throughout.

- Chapter 11 Process: Most complex and lengthy. Filing -> Automatic Stay -> Debtor in Possession operates business -> File Schedules and Statements -> Creditors Committees Formed -> Debtor Proposes Plan of Reorganization -> Negotiation and Voting on Plan -> Plan Confirmation Hearing (can be a year or more post-filing) -> Implement Confirmed Plan -> Discharge of Debt (typically upon confirmation or substantial consummation of plan). Focuses on business continuation and restructuring.

Understanding these distinct bankruptcy process timelines and steps is crucial when choosing among the 3 Types of Bankruptcies based on your goals and capacity to comply with the requirements.

Key Differences in Outcomes and Bankruptcy Benefits Among the 3 Types of Bankruptcies

The ultimate outcomes and the nature of the bankruptcy benefits received vary significantly among the 3 Types of Bankruptcies.

- Chapter 7 Outcomes: Provides a rapid discharge of debt for most unsecured debts, offering a quick financial fresh start. Key bankruptcy benefits include fast debt relief and protection of exempt assets. Potential consequence: loss of non-exempt assets.

- Chapter 13 Outcomes: Provides a discharge of debt for remaining dischargeable debts after completing a 3-5 year repayment plan. Key bankruptcy benefits include the ability to stop foreclosure/repossession, catch up on secured debts, keep non-exempt assets, and manage non-dischargeable debts through the plan. Offers a structured financial fresh start after plan completion.

- Chapter 11 Outcomes: For businesses, leads to confirmation of a Chapter 11 Plan of Reorganization, allowing the business to restructure and continue operating, achieving discharge of debt for restructured debts upon confirmation/completion. Key bankruptcy benefits include business survival, job preservation, and restructuring of complex finances. For individuals in Chapter 11, similar restructuring benefits apply to their complex debts. Offers a comprehensive financial fresh start for the reorganized entity or individual.

In summary, the 3 Types of Bankruptcies – Chapter 7, Chapter 13, and Chapter 11 – are distinct legal pathways under the Bankruptcy Code, each tailored to different financial situations and goals. Understanding what are the 3 Types of Bankruptcies and their specific eligibility criteria, bankruptcy process, and potential bankruptcy benefits and outcomes is vital for individuals and businesses seeking debt relief and a financial fresh start. Choosing the right type depends on whether the goal is rapid liquidation (Chapter 7 bankruptcy), a structured repayment plan (Chapter 13 bankruptcy), or complex reorganization (Chapter 11 bankruptcy), all within the overarching framework of Bankruptcy Law.